When you shop online, the last thing you want to worry about is the security of your transactions. Whether you’re a business owner or a frequent online shopper, choosing the right e-commerce payment gateway in Malaysia is crucial.

You’re looking for a system that keeps your personal information safe while making the checkout process smooth and hassle-free. But with so many options available, how do you decide which one is best for you? Imagine the peace of mind that comes with knowing your transactions are secure.

Picture the ease of completing a purchase without any technical glitches or worries about fraud. This is what the right payment gateway offers. You’ll discover how to select a gateway that meets your needs, ensuring both security and convenience. We’ll dive into the features that matter most and guide you toward making an informed decision. Keep reading to unlock the secrets to secure and seamless e-commerce transactions in Malaysia. Your perfect payment solution is just a few scrolls away!

E-commerce Growth In Malaysia

The e-commerce landscape in Malaysia is experiencing a remarkable surge, reshaping the way people shop and do business. With the increasing internet penetration and smartphone usage, more Malaysians are embracing the convenience of online shopping. This growth brings both opportunities and challenges, especially when it comes to secure payment processing.

Why E-commerce Is Thriving In Malaysia

Malaysia’s e-commerce sector is booming due to several factors. The widespread use of smartphones has made online shopping more accessible than ever. Coupled with affordable data plans, you can browse and buy products anytime, anywhere.

Another reason is the country’s supportive infrastructure. The government’s initiatives to enhance digital literacy and connectivity are encouraging more businesses to go online. This has created a fertile ground for e-commerce growth.

The Role Of Payment Gateways In E-commerce Growth

As e-commerce grows, the demand for secure payment solutions rises. Payment gateways play a crucial role in facilitating seamless transactions. They ensure that your financial data is protected from cyber threats.

Imagine shopping online without worrying about your credit card information being compromised. That’s the peace of mind that a reliable payment gateway offers. Choosing the right one can significantly impact your business and customer satisfaction.

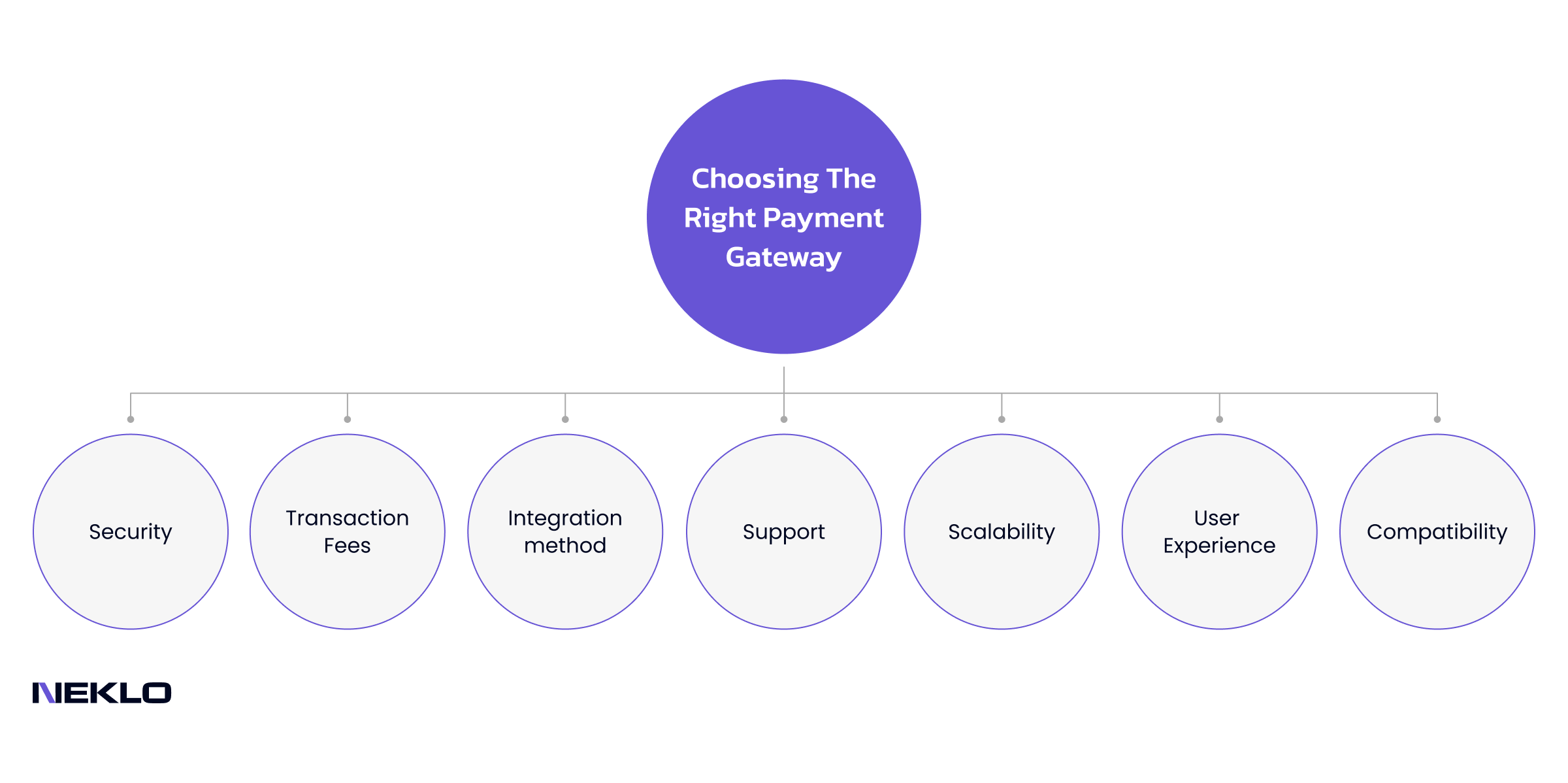

Choosing The Right Payment Gateway For Your Business

Not all payment gateways are created equal. Some offer advanced security features, while others provide better integration with your e-commerce platform. Consider the nature of your business and the needs of your customers when selecting one.

Are you prioritizing speed, security, or cost? It’s crucial to weigh these factors and choose a payment gateway that aligns with your business goals. A well-chosen gateway can enhance your e-commerce site’s functionality and user experience.

Impact On Consumer Trust And Business Growth

Secure payment gateways boost consumer trust. When customers feel confident about the security of their transactions, they are more likely to return. This trust is vital for converting one-time buyers into loyal customers.

Your choice of payment gateway can directly affect your business growth. A seamless and secure checkout process can reduce cart abandonment rates and increase sales. Are you leveraging this to maximize your business potential?

As you navigate the e-commerce landscape in Malaysia, think about how you can optimize your payment processes. The right gateway could be the key to unlocking new levels of success for your business.

Importance Of Payment Gateways

In the world of e-commerce, payment gateways hold significant importance. They act as the bridge between your online store and customers. Ensuring secure and smooth transactions is their primary function. For businesses in Malaysia, choosing the right payment gateway is crucial. It impacts customer trust and business growth. Let’s delve into why payment gateways are essential.

What Is A Payment Gateway?

A payment gateway processes transactions for online businesses. It connects the merchant’s website to the bank. It ensures secure and swift transfer of payment information. It encrypts sensitive data, protecting it from threats. This process builds trust with customers.

Enhancing Customer Trust

Trust is vital in e-commerce. Secure payment gateways assure customers their data is safe. This assurance increases their confidence in your business. They are more likely to complete their purchases. A secure payment system can lead to repeat customers.

Seamless User Experience

A good payment gateway offers a smooth transaction process. It ensures quick and hassle-free payments. This improves the overall shopping experience. Customers appreciate convenience and ease. It can lead to higher conversion rates.

E-commerce faces threats from fraud. Payment gateways have security measures to combat this. They use encryption and fraud detection tools. These protect both businesses and customers. It reduces the risk of financial loss.

Supporting Multiple Payment Methods

Customers prefer different payment methods. A versatile payment gateway supports multiple options. Credit cards, debit cards, and digital wallets are included. This flexibility caters to a broader audience. It enhances customer satisfaction.

Facilitating International Transactions

Many businesses aim to reach global markets. A good payment gateway supports international payments. It handles multiple currencies and languages. This feature expands the customer base. It aids in business growth beyond borders.

Key Features Of Payment Gateways

Choosing the right payment gateway is crucial for secure online transactions. It ensures that your customers have a seamless shopping experience. In Malaysia, various gateways offer diverse features. Understanding these features helps in selecting the best option for your e-commerce business.

Security And Fraud Prevention

Security is the top priority in any payment gateway. Look for gateways that offer advanced encryption methods. This protects sensitive customer data from cyber threats. Fraud detection tools are also important. They help in identifying suspicious transactions promptly.

User-friendly Interface

A simple interface enhances the customer’s checkout experience. An intuitive design is vital. It reduces cart abandonment rates. Make sure the gateway integrates easily with your e-commerce platform. This ensures a smooth transaction process.

Multiple Payment Options

Offering various payment methods is essential. This includes credit cards, bank transfers, and e-wallets. Customers appreciate flexibility. A gateway with multiple options caters to diverse preferences. It improves customer satisfaction and retention.

Transaction Speed

Fast transaction processing is crucial for customer satisfaction. Delays can lead to frustration and lost sales. Ensure the gateway processes transactions quickly. This enhances customer trust and loyalty.

Cost And Fees

Cost is a significant factor in choosing a gateway. Evaluate the transaction fees carefully. Some gateways charge setup fees or monthly fees. Consider the overall cost to determine the best fit for your budget.

Reliable customer support is essential. Issues can arise at any time. Ensure the gateway provides 24/7 support. Prompt assistance helps in resolving problems quickly. This maintains a positive relationship with your customers.

Credit: www.shopify.com

Security Measures

Choosing a secure e-commerce payment gateway in Malaysia ensures safe transactions for buyers and sellers. Prioritize gateways with strong encryption and fraud detection. This helps protect sensitive financial information and boosts customer trust.

Choosing a payment gateway for your e-commerce business in Malaysia is a critical decision, especially when it comes to ensuring secure transactions. With rising cyber threats, it’s essential to prioritize security measures that protect both you and your customers. Understanding these measures can save you from potential financial loss and build trust with your clientele.Understanding Encryption Technologies

Encryption is a cornerstone of secure online transactions. It scrambles data into a code that only authorized parties can decipher. Picture it as a lock and key system protecting sensitive information like credit card numbers. Always ensure your chosen payment gateway uses advanced encryption methods, such as SSL (Secure Socket Layer) or TLS (Transport Layer Security).Two-factor Authentication (2fa)

Two-factor authentication is like adding an extra deadbolt to your door. It requires users to verify their identity in two steps—usually a password plus a temporary code sent to their phone. This extra layer of security makes it significantly harder for cybercriminals to access your account. Ensure your payment gateway supports 2FA to protect sensitive data.Fraud Detection And Prevention

Effective fraud detection tools are vital. They monitor transactions in real-time, flagging unusual patterns or high-risk activities. Think of it as having a vigilant security guard watching over your transactions. Opt for gateways that offer robust fraud detection systems. These systems can help prevent unauthorized transactions, saving you from potential chargebacks.Pci Dss Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect card information. Compliance with PCI DSS means your payment gateway meets the necessary safety requirements. This compliance is crucial for any e-commerce platform dealing with card payments. Check if your gateway provider is PCI DSS compliant, ensuring they uphold stringent security protocols.Regular Security Audits

Regular security audits are akin to health check-ups for your payment system. They help identify vulnerabilities before they can be exploited. Consider it a proactive approach to maintaining security. Inquire if your gateway provider conducts routine audits and updates their systems to tackle emerging threats.Secure Apis And Webhooks

APIs and webhooks facilitate communication between your website and the payment gateway. Ensuring these are secure is paramount. They should have authentication measures and be encrypted to prevent unauthorized access. When choosing a payment gateway, verify that they offer secure APIs and webhooks to maintain data integrity. In your journey to select the best e-commerce payment gateway in Malaysia, prioritize security measures. By doing so, you not only protect your business but also enhance customer trust. What measures does your current payment gateway have in place? Are there additional security features you believe are necessary for your peace of mind?Fraud Prevention

Fraud prevention is crucial in e-commerce. It protects businesses and customers. In Malaysia, choosing the right payment gateway helps ensure secure transactions. A gateway with strong fraud prevention measures builds trust. It reduces risks and enhances customer satisfaction.

Understanding Fraud Detection Technology

Effective fraud detection technology is essential. It identifies suspicious activities quickly. Advanced algorithms analyze transaction patterns. They can spot anomalies. This helps prevent unauthorized transactions.

Importance Of Data Encryption

Data encryption safeguards sensitive information. It transforms data into unreadable code. Only authorized parties can access it. This protects payment details from cybercriminals.

Role Of Real-time Monitoring

Real-time monitoring provides constant vigilance. It keeps track of transactions as they occur. Immediate alerts notify businesses of potential threats. Swift action can prevent fraud.

Two-factor Authentication Benefits

Two-factor authentication adds an extra security layer. Users verify their identity in two steps. This makes it harder for fraudsters to access accounts. It enhances transaction security.

Choosing A Gateway With Fraud Prevention Features

Select gateways with robust fraud prevention features. Look for those offering real-time monitoring and data encryption. Ensure they provide two-factor authentication. These features boost security and customer confidence.

Credit: www.bigcommerce.com

User Experience

The user experience is a critical aspect of selecting the right e-commerce payment gateway in Malaysia. When shopping online, you want every transaction to be smooth and hassle-free. A seamless user experience not only boosts customer satisfaction but also enhances trust in your online store.

Intuitive Interface

Imagine visiting a website and struggling to find the checkout button. Frustrating, right? A payment gateway should offer a simple, intuitive interface that guides users effortlessly through the transaction process. The fewer clicks, the better. Users appreciate when everything is clear and straightforward, making them more likely to complete their purchase.

Fast Loading Time

Time is of the essence in online shopping. Studies show that even a second’s delay in loading time can lead to a drop in conversion rates. A fast-loading payment gateway ensures that your customers don’t abandon their carts out of impatience. Speed is crucial; it keeps the momentum going and ensures a satisfying shopping experience.

Mobile Friendliness

With mobile shopping on the rise, your payment gateway must be mobile-friendly. Picture a potential customer using their smartphone to buy your product. If the payment page isn’t optimized for mobile, you might lose that sale. A responsive design adapts to any device, ensuring that transactions are smooth whether on desktop or mobile.

Multiple Payment Options

Diversity in payment options can make or break a sale. Offering various payment methods caters to different customer preferences. Whether it’s credit cards, e-wallets, or bank transfers, flexibility enhances user experience. Providing multiple choices can be the nudge a hesitant buyer needs to complete their purchase.

Security Features

Security is a top priority for online shoppers. But how do you ensure your customers feel safe? A payment gateway that prominently displays its security features—like SSL certificates and encryption protocols—instills confidence. Customers need to know their sensitive information is protected, which can significantly influence their purchasing decision.

User experience in payment gateways is about making online transactions as easy and secure as possible. Ask yourself: Is your payment process streamlined enough to keep customers coming back? By focusing on these aspects, you can enhance user satisfaction and drive your e-commerce success in Malaysia.

Popular Payment Gateways In Malaysia

Choosing a reliable payment gateway ensures secure transactions for e-commerce in Malaysia. Options like PayPal, iPay88, and MOLPay offer robust protection. Users can enjoy safe and smooth online shopping with these trusted services.

Choosing the right e-commerce payment gateway is crucial for your online business in Malaysia. With so many options available, selecting one that aligns with your needs can be overwhelming. But don’t worry—you’re not alone. Many entrepreneurs face this challenge. Let’s dive into some of the most popular payment gateways used by e-commerce businesses in Malaysia. These gateways not only ensure secure transactions but also enhance customer experience.Paypal

PayPal is a household name globally, known for its secure and user-friendly platform. It’s widely used in Malaysia, offering seamless integration with most shopping carts. You can easily set up a PayPal account and start accepting payments almost instantly. It’s ideal if you want a straightforward solution without fuss. PayPal also offers buyer protection, which can boost your customers’ confidence in making purchases from your site. Have you ever hesitated to buy something online due to security concerns? PayPal’s robust security measures aim to alleviate those fears.Ipay88

iPay88 is a leading local payment gateway, tailored specifically for Malaysian businesses. It supports a wide range of payment methods, including credit cards, bank transfers, and e-wallets. If you’re targeting Malaysian customers, iPay88 might be your perfect match. It offers competitive rates and local support, making it easier for you to resolve any issues. Imagine not having to worry about payment-related hiccups because you have a team ready to assist you in your time zone.Molpay

MOLPay is another popular choice among Malaysian e-commerce businesses. It provides a comprehensive suite of payment options, including cash payments at physical locations. This gateway is particularly beneficial if you want to offer your customers the flexibility of online and offline payment methods. Think about the convenience of shopping online and paying cash at a nearby convenience store. It’s a unique selling point that could set your business apart.Stripe

Stripe is renowned for its developer-friendly API and global reach, which is increasingly gaining popularity in Malaysia. It’s perfect for tech-savvy entrepreneurs looking for customization. If you have a knack for coding, Stripe allows you to tailor your payment gateway to fit your business model perfectly. Ever wanted to add a specific feature to your checkout process? With Stripe, the sky’s the limit.Razer Merchant Services

Razer Merchant Services caters to the gaming and e-commerce sectors, providing a robust payment solution that supports multiple currencies. It’s an excellent choice if your business operates internationally. Razer’s platform ensures transactions are smooth and secure, regardless of where your customers are located. Do you have international customers who need to pay in different currencies? This gateway seamlessly handles cross-border transactions. In choosing a payment gateway, you should consider factors like ease of integration, transaction fees, and customer support. Which feature is most important to you? Reflect on your business needs and customer preferences. Your choice could make or break your e-commerce success in Malaysia.Transaction Fees

Choosing the best e-commerce payment gateway in Malaysia involves many considerations, and understanding transaction fees is crucial. These fees can significantly impact your business’s profitability, especially if you are operating on thin margins. It’s important to know what you’re getting into to avoid surprises later on.

What Are Transaction Fees?

Transaction fees are the charges that payment gateways impose on each sale made through their platform. They typically include a percentage of the total sale and may have a flat fee added per transaction. These fees are how payment gateways earn revenue for providing their services.

Why Should You Care About Transaction Fees?

Every transaction fee eats into your profit margin. If you’re not careful, these fees can accumulate and affect your bottom line. As a business owner, understanding these costs allows you to make informed decisions and strategize accordingly.

Comparing Fees Among Payment Gateways

In Malaysia, popular payment gateways like PayPal, Stripe, and iPay88 have different fee structures. PayPal charges a flat rate plus a percentage, whereas Stripe is more transparent with a straightforward percentage rate. iPay88 offers competitive rates but may have additional setup costs.

Negotiating Better Rates

Did you know you can negotiate transaction fees with some payment gateways? If you have a high volume of sales, reaching out to the provider could lead to reduced rates. This negotiation could save you substantial amounts annually.

Hidden Costs To Watch Out For

Besides transaction fees, be aware of hidden costs like currency conversion fees and chargeback fees. These can sneak up on you if you’re dealing with international transactions. Always read the fine print before committing to a payment gateway.

Choosing The Right Gateway For Your Business

Think about your business model and sales volume. If most of your transactions are small, a gateway with lower percentage fees might be beneficial. Conversely, if your sales are larger, a lower flat fee could be more advantageous.

The Impact On Customer Experience

Transaction fees can also affect your pricing strategy and, consequently, customer experience. If fees are too high, you might need to increase prices, potentially deterring customers. Balancing costs while maintaining competitive pricing is key.

Are you willing to compromise on fee amounts for better customer service or more features? It’s a question every business owner should consider when choosing a payment gateway.

Integration With E-commerce Platforms

Selecting the right payment gateway in Malaysia ensures secure online transactions. It builds customer trust and enhances sales. Seamless integration with e-commerce platforms is key for a smooth checkout process.

Choosing the right e-commerce payment gateway in Malaysia is crucial for the seamless operation of your online store. One of the key factors to consider is how well the payment gateway integrates with your e-commerce platform. Integration affects not only the efficiency of transactions but also the overall shopping experience for your customers.Integration With Popular Platforms

Many e-commerce platforms like Shopify, WooCommerce, and Magento dominate the market. Look for payment gateways that offer straightforward integration with these platforms. Some gateways come with pre-built plugins that make the setup process a breeze, saving you time and technical hassle.Customization Capabilities

Does the payment gateway allow you to customize its interface to match your brand? A cohesive brand experience can enhance customer trust and loyalty. Check if the gateway offers customizable features like payment buttons and checkout pages that align with your site’s aesthetic.Technical Support And Documentation

Even the best systems can encounter issues. Ensure that the payment gateway provides robust technical support and comprehensive documentation. Look for resources like FAQs, video tutorials, and 24/7 customer service to assist you in resolving any integration challenges.Testing And Sandbox Environment

Before going live, you should test the integration thoroughly. Does the payment gateway offer a sandbox environment? This is essential for running test transactions without risking real customer data. A reliable sandbox feature allows you to fine-tune the process and ensure everything works smoothly.Security Protocols And Compliance

Security is a top priority when dealing with online payments. Verify whether the payment gateway complies with global security standards such as PCI DSS. This ensures that both you and your customers are protected from fraud and data breaches.Have you ever faced challenges when integrating a payment gateway into your e-commerce platform? Share your experience in the comments. Your insights could help someone else on their journey to secure transactions in Malaysia’s vibrant e-commerce landscape.

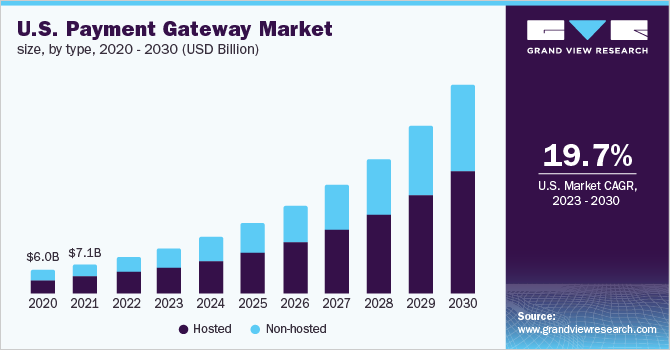

Credit: www.grandviewresearch.com

Mobile Payment Options

Mobile payment options have transformed how Malaysians shop online. They offer convenience and security, making transactions seamless. As smartphones become more common, people want fast and easy payment methods. Picking the right mobile payment gateway is crucial for e-commerce success in Malaysia.

Understanding Mobile Payment Gateways

Mobile payment gateways act as intermediaries between customers and merchants. They process payments securely and efficiently. Choosing the right one ensures smooth transactions and customer trust.

Popular Mobile Payment Options In Malaysia

Malaysia offers several mobile payment options. Each provides unique features and benefits. Boost and Touch ‘n Go eWallet are popular choices. They provide easy and secure payment solutions.

Benefits Of Mobile Payment Gateways

Mobile payment gateways offer enhanced security features. They protect sensitive customer data. They also simplify the checkout process, reducing cart abandonment rates.

Factors To Consider When Choosing A Payment Gateway

Look at transaction fees and compatibility with existing systems. Security features and user experience are vital. Ensure the gateway supports various payment methods. This flexibility can attract more customers.

Future Of Mobile Payments In Malaysia

Mobile payments are likely to grow in Malaysia. Improved technology and increased smartphone usage drive this trend. Businesses must adapt to meet customer demands.

Customer Support

Secure transactions are vital in e-commerce. Selecting the right payment gateway in Malaysia ensures customer protection. Choose wisely for safe online shopping experiences.

Choosing the right e-commerce payment gateway is crucial for ensuring secure transactions in Malaysia. A significant aspect to consider is customer support. When you’re running an online business, having reliable customer support can make a difference in maintaining smooth operations and enhancing customer satisfaction. Imagine a scenario where a payment issue arises at midnight. Without prompt customer support, this could lead to frustrated customers and potential revenue loss.Understanding The Importance Of Responsive Support

Responsive support is essential for addressing issues promptly. It builds trust with your customers, knowing they can rely on you to solve their problems swiftly. Choose a payment gateway that offers 24/7 support. This ensures that regardless of the time, you can get assistance when you need it the most.Types Of Customer Support Offered

Different payment gateways offer various types of support. Common options include live chat, email, and phone support. Live chat is often the quickest way to resolve issues, especially during peak business hours. Phone support can provide a more personal touch, while email is useful for less urgent queries.Evaluating The Quality Of Support

Quality is just as important as availability. Test the support services before making a decision. Send inquiries and assess the response time and quality of the solutions provided. Are they knowledgeable and helpful? This can give you a better idea of what to expect in real situations.Languages And Local Support

In a multicultural country like Malaysia, language support is vital. Check if the payment gateway offers support in languages you and your customers are comfortable with. Local support can also mean better understanding of regional issues. This can lead to faster and more effective solutions.Customer Support As A Competitive Edge

Think of customer support as a competitive edge. Excellent support can set your business apart from others. When customers know that their issues will be handled efficiently, they are more likely to return and recommend your business to others. When selecting a payment gateway, don’t overlook customer support. It can be the backbone of a seamless e-commerce experience. What’s your experience with customer support in e-commerce? Share your thoughts in the comments!Payment Gateway Compliance

Choosing the right e-commerce payment gateway in Malaysia is crucial for secure transactions, and understanding payment gateway compliance is a key part of this process. Compliance ensures your chosen gateway adheres to the necessary legal and security standards, protecting both you and your customers. Without compliance, you risk losing customer trust and facing financial penalties.

Understanding Pci Dss Compliance

PCI DSS, or Payment Card Industry Data Security Standard, is a set of security standards designed to ensure that all companies accepting, processing, storing, or transmitting credit card information maintain a secure environment. In Malaysia, PCI DSS compliance is a must for any payment gateway. Ask yourself: Is your current gateway compliant? If not, it might be time to switch.

PCI DSS compliance can be complex. It involves maintaining a secure network, protecting cardholder data, and regularly monitoring systems. Imagine you run a small online store; ensuring PCI DSS compliance might seem overwhelming. But remember, without it, you expose your business to significant risks.

Local Regulations And Compliance

Malaysia has its own set of regulations for e-commerce transactions. The Personal Data Protection Act (PDPA) is one such regulation, ensuring customer data privacy. A compliant payment gateway will align with these local laws, safeguarding sensitive customer information.

Picture this: You’re a consumer who just made an online purchase. Wouldn’t you want assurance that your personal data is safe? As a business owner, selecting a gateway that complies with local laws not only protects your customers but also enhances your reputation.

Ensuring Security Protocols

Security protocols go hand in hand with compliance. A robust payment gateway will have advanced security measures, such as encryption and tokenization. These protocols prevent unauthorized access to sensitive data.

Consider your own experiences shopping online. Have you ever hesitated entering your credit card details due to security concerns? By choosing a gateway with strong security protocols, you alleviate these worries for your customers, encouraging more sales.

Regular Audits And Updates

Compliance isn’t a one-time event; it’s an ongoing process. A reliable payment gateway will conduct regular audits and updates to stay compliant with evolving standards. This proactive approach keeps your e-commerce operations secure.

Think about how technology changes rapidly. What was secure last year might not be secure today. By ensuring your payment gateway is regularly updated, you stay ahead of potential threats and maintain customer trust.

Conclusion: Making An Informed Choice

Choosing the right e-commerce payment gateway in Malaysia means prioritizing compliance. Assess your current gateway’s adherence to PCI DSS, local regulations, and security protocols. Regular audits and updates further ensure your gateway remains secure.

So, as you navigate your options, ask yourself: Is my payment gateway truly compliant? By focusing on compliance, you protect your business and your customers, paving the way for secure and successful transactions.

Scalability For Business Growth

Selecting a reliable e-commerce payment gateway is essential for secure transactions in Malaysia. Businesses need scalable solutions to support growth while ensuring customer trust. Opt for gateways offering robust security features and user-friendly interfaces to enhance the shopping experience.

Scalability is crucial for any business aiming for growth, especially in the dynamic world of e-commerce. As your online store in Malaysia begins to attract more customers, the payment gateway you choose must be able to handle increased transactions seamlessly. An efficient, scalable payment gateway ensures your business doesn’t suffer from downtime or slow processing speeds during peak times.Understanding Scalability In Payment Gateways

When choosing a payment gateway, it’s vital to consider if it can scale with your business. A scalable gateway should support an increasing number of transactions without a hitch. This means no delays, errors, or customer frustrations. Can your current gateway handle a flash sale or holiday rush?Features That Support Growth

Look for payment gateways that offer features supporting business expansion. For instance, the ability to accept multiple currencies can help you tap into international markets. Also, consider gateways that offer fraud prevention tools to safeguard your growing business.Real-life Examples Of Scalable Payment Gateways

Some Malaysian businesses have successfully used gateways like iPay88 and MOLPay, which offer scalability. These platforms support high transaction volumes and feature robust security measures. Could one of these be the right fit for your business?Cost Vs. Scalability

While selecting a payment gateway, weigh the cost against its scalability. Some gateways may charge higher fees for increased transactions, which can impact your bottom line. However, a scalable solution often pays off in the long run by supporting your growth without limitations. Are you willing to invest in a gateway that grows with you?Preparing For Future Growth

Planning for growth means anticipating future needs. A scalable payment gateway allows you to focus on expanding your business without worrying about transaction limits. Is your payment system ready for the next big leap? Choosing the right payment gateway is more than just a technical decision; it’s a strategic move that can significantly impact your business’s trajectory. Assess your current and future needs, and make an informed choice that will support your growth ambitions.Customization And Flexibility

E-commerce payment gateways in Malaysia offer customization and flexibility to meet diverse business needs. Tailor transactions by selecting features that enhance security and user experience. Adaptable solutions ensure safe, seamless transactions for customers.

In Malaysia’s booming e-commerce landscape, selecting the right payment gateway is crucial. Customization and flexibility play a vital role. These features help businesses tailor the payment process. This ensures a seamless user experience. A flexible payment gateway adapts to various business needs. It enhances customer satisfaction and boosts sales. Let’s explore how customization and flexibility can benefit your e-commerce business.Customizable Payment Options

Offering various payment options caters to diverse customer preferences. Credit cards, bank transfers, and digital wallets are popular choices. A customizable gateway allows you to include these options. Businesses can easily integrate or remove payment methods as needed. This adaptability ensures you cater to a broader audience.Seamless Integration With Platforms

A flexible payment gateway integrates smoothly with different platforms. Whether using Shopify, WooCommerce, or Magento, integration is simple. It saves time and effort for business owners. Seamless integration reduces the chances of technical issues. This ensures a smooth transaction process for users.Personalized User Experience

A personalized user experience builds customer trust. Customizable gateways allow you to brand the payment page. You can match it with your website’s theme. This consistency makes users feel secure during transactions. Personalization also includes language and currency options. These features enhance the shopping experience for international customers.Scalability For Growing Businesses

As businesses grow, their needs change. A flexible payment gateway supports scalability. It can handle increased transaction volumes without issues. This ensures a smooth checkout process during peak times. Scalability also allows the addition of new features. This keeps your payment system updated with the latest trends.Enhanced Security Features

Security is crucial in online transactions. Flexible gateways offer customizable security features. You can choose additional layers of protection. This includes fraud detection and encryption technologies. Enhanced security builds customer confidence. It ensures safe transactions and protects sensitive data.Cost-effective Solutions

Customization options often come with cost benefits. Businesses can choose features that suit their budget. Flexible gateways avoid unnecessary expenses. You pay only for the features you need. This approach makes it a cost-effective solution for many businesses.Multi-currency Support

Supporting multiple currencies simplifies transactions for international customers. Choose a payment gateway in Malaysia that guarantees secure transactions. Enhance your e-commerce platform with efficient currency management.

The e-commerce landscape in Malaysia is buzzing with opportunities, and one of the critical aspects that can set your online store apart is the ability to handle multi-currency transactions seamlessly. Multi-currency support is more than a convenience; it’s a necessity for businesses aiming to appeal to a global audience. In a world where customers shop from every corner of the globe, ensuring they can pay in their currency is a significant step toward enhancing customer satisfaction and expanding your market reach.Understanding Multi-currency Support

Multi-currency support means that your payment gateway can process transactions in various currencies. This feature is crucial for businesses targeting international customers. When shoppers see prices in their currency, they’re more likely to trust your site and complete the purchase.Benefits Of Multi-currency Payment Gateways

First, it reduces the chance of cart abandonment. Customers are often deterred when they see prices in an unfamiliar currency. Secondly, it provides a competitive edge. With more businesses entering the e-commerce space, offering multi-currency options can differentiate your store. Lastly, it builds trust. Customers feel more confident in making a purchase when they see familiar currency symbols.Choosing The Right Gateway For Multi-currency Transactions

Not all payment gateways offer the same level of multi-currency support. It’s vital to choose one that aligns with your target markets. Some gateways automatically convert prices, while others require manual input. Look for gateways that offer real-time exchange rates, as this ensures accuracy and transparency.Real-world Example: A Malaysian Business Success Story

Consider a Malaysian entrepreneur who expanded her handmade jewelry business internationally. By selecting a payment gateway with robust multi-currency support, she was able to attract customers from Europe and the United States. The ability to display prices in Euros and US Dollars significantly boosted her sales. Her story highlights the practical benefits of choosing the right payment gateway.Practical Steps To Implement Multi-currency Support

Start by evaluating your current and potential international markets. Determine which currencies are most relevant to your audience. Then, assess the compatibility of your e-commerce platform with different payment gateways. Implementing multi-currency support might require some initial setup, but the long-term benefits are worth the effort.Challenges And Considerations

While multi-currency support offers many advantages, it also comes with challenges. Exchange rate fluctuations can impact pricing, so it’s essential to keep rates updated. Consider any additional fees associated with currency conversion, as these can affect your profit margins. Are you prepared to offer multi-currency transactions to your customers? Embracing this feature can open doors to a global market and significantly enhance your customer experience.Local Vs. International Providers

Choosing between local and international payment gateways in Malaysia affects secure transactions. Local providers understand regional needs. International options offer global security features.

Choosing the right e-commerce payment gateway in Malaysia can be a daunting task, especially when deciding between local and international providers. Both options have unique benefits and challenges. By understanding the differences, you can make a more informed decision that suits your business needs.Local Providers: Tailored For The Malaysian Market

Local payment gateways often offer solutions specifically designed for the Malaysian market. They understand local consumer behavior and preferences, which can be a significant advantage. For instance, they might support payment methods that are popular in Malaysia like FPX or DuitNow. This can lead to a smoother checkout experience for your customers, potentially increasing your sales. Additionally, local providers usually offer customer support in Malay and English, which can be helpful if any issues arise.International Providers: Broad Reach And Advanced Features

International payment gateways often come with a reputation for reliability and security. They have a proven track record and are trusted by businesses worldwide. These providers usually offer a wide range of payment methods, including credit cards and digital wallets, which can be appealing if you plan to reach a global audience. However, they might not support some local payment options, which could be a drawback if your primary market is in Malaysia.Cost Considerations: Weighing The Fees

Cost is a critical factor when choosing between local and international providers. Some local providers may offer lower transaction fees, which can be beneficial for small businesses. On the other hand, international providers might charge higher fees but offer advanced security features and fraud protection. It’s essential to balance cost with the level of service you require.Integration And Compatibility: Ensuring Smooth Operations

Consider how easily a payment gateway integrates with your current e-commerce platform. Local providers may offer seamless integration with popular Malaysian platforms like Shoppee or Lazada. International gateways often provide plugins and APIs for global platforms such as Shopify or WooCommerce. Ensure the provider you choose offers a solution that aligns with your existing systems.Customer Support: Resolving Issues Quickly

Reliable customer support is crucial for handling any payment issues swiftly. Local providers may offer more personalized support, understanding the nuances of the Malaysian market. International providers, however, often have 24/7 support and multilingual teams, which can be invaluable if you operate across different time zones. Which type of support would your business benefit from the most? Consider this when making your choice. Choosing the right payment gateway isn’t just about cost or features—it’s about understanding your business needs and what will best serve your customers.Evaluating Gateway Performance

Choosing the right e-commerce payment gateway is crucial for secure transactions in Malaysia. Evaluating gateway performance helps ensure smooth and reliable operations. This section focuses on key factors to consider when assessing payment gateway efficiency.

Speed And Reliability

Speed determines how quickly transactions process. A fast gateway enhances customer satisfaction. Reliability ensures consistent performance without frequent outages. Choose gateways with proven uptime records.

Security Features

Security protects sensitive customer data. Look for gateways that offer encryption and fraud detection tools. These features safeguard transactions and build trust with users.

User-friendly interfaces simplify the payment process. Customers appreciate intuitive navigation and seamless checkout experiences. Evaluate gateways with streamlined designs that reduce cart abandonment.

Integration Capabilities

Integration with existing systems is essential for smooth operations. Check compatibility with popular e-commerce platforms. Choose gateways that offer easy integration and minimal technical challenges.

Cost Efficiency

Cost affects overall business profitability. Examine transaction fees and setup costs. Opt for gateways that provide value without hidden charges. Balance cost with performance to achieve sustainable growth.

Responsive support is crucial for resolving issues quickly. Look for gateways with 24/7 assistance. Effective support minimizes downtime and enhances user satisfaction.

Case Studies Of Successful Implementations

Discover how businesses in Malaysia have excelled with secure payment gateways. These real-world examples highlight effective strategies and outcomes. Learn from their experiences and apply their insights to your own e-commerce platform.

Case Study 1: Local Fashion Retailer

A popular fashion retailer in Kuala Lumpur adopted a secure payment gateway. The company saw an increase in customer trust and sales. They ensured seamless integration with their existing website. This boosted user experience and reduced cart abandonment rates.

Case Study 2: Online Electronics Store

An electronics store chose a payment gateway with advanced security features. They wanted to protect customer data from fraud. Their choice led to fewer chargebacks and increased customer loyalty. The store’s reputation for safety strengthened its market position.

Case Study 3: Home Decor Company

A home decor company focused on ease of use and security. They selected a gateway that offered multiple payment options. This flexibility attracted more customers. The secure system improved their conversion rates significantly.

Case Study 4: Health Products Supplier

A health products supplier needed a reliable payment solution. They picked a gateway with round-the-clock support. This ensured quick issue resolution and minimized downtime. Their online sales grew, and customer satisfaction increased.

Future Trends In Payment Gateways

As e-commerce grows in Malaysia, the need for secure payment systems increases. Payment gateways are evolving to meet consumer demands. Let’s explore some future trends in this space.

Integration Of Artificial Intelligence

AI is transforming payment gateways. It enhances security and speeds up transactions. AI algorithms detect fraudulent activities quickly. This ensures safer online shopping experiences.

Rise Of Digital Wallets

Digital wallets are gaining popularity. They offer convenience and security. Users can make purchases without entering card details. This trend is set to grow in Malaysia.

Biometric Authentication

Biometric authentication is becoming more common. Fingerprint and facial recognition provide extra security. Consumers appreciate the ease and speed of biometric methods.

Blockchain Technology

Blockchain offers transparency and security. It reduces the risk of fraud. Transactions are recorded in a decentralized ledger. This could be a game-changer for payment gateways.

Contactless Payments

Contactless payments are on the rise. They offer a fast and safe way to pay. Consumers enjoy the convenience of tap-and-go transactions.

Cross-border Transactions

Global e-commerce is expanding. Secure cross-border transactions are important. Payment gateways are adapting to support multiple currencies seamlessly.

Subscription-based Models

Subscription services are growing. Payment gateways need to manage recurring payments efficiently. This trend requires reliable and flexible systems.

Choosing The Right Gateway For Your Business

Selecting the right e-commerce payment gateway in Malaysia ensures secure transactions for your business. Prioritize options offering robust security features and seamless integration to enhance customer trust and streamline operations.

Choosing the right e-commerce payment gateway is crucial for your business in Malaysia. The right choice can enhance your customer’s shopping experience, boost your sales, and keep your transactions secure. With so many options available, how do you decide which gateway fits your business needs best?Understand Your Business Needs

Begin by assessing your business requirements. Do you have more international or local customers? Some gateways offer better foreign exchange rates, which can be a plus for businesses with international clientele. Consider the volume of transactions you expect. If you’re just starting, you might opt for a gateway with lower fees for smaller transactions.Prioritize Security Features

Security should be at the forefront of your decision-making process. Look for gateways that offer robust security features like encryption and fraud detection. A friend once shared how a lack of security led to a data breach in their online store, causing customer trust to plummet. This could easily be avoided with a secure payment gateway.Evaluate Ease Of Integration

Examine how easily the payment gateway integrates with your existing e-commerce platform. You want a solution that doesn’t require a complete overhaul of your system. Check if the gateway supports popular platforms like WooCommerce or Shopify. A seamless integration ensures a smoother customer journey from cart to checkout.Consider Customer Support

Reliable customer support can be a game changer. Imagine a customer facing an issue during checkout – having timely support can prevent losing a sale. Look for gateways that offer round-the-clock support via multiple channels. This ensures that help is available whenever you or your customers need it.Analyze Costs And Fees

Examine the cost structure of potential gateways. Are there setup fees, transaction fees, or monthly charges? Compare these with your projected sales to find a cost-effective solution. An expensive gateway might erode your profits, while a cheaper one might lack essential features. Choosing the right payment gateway can significantly impact your business’s success. By focusing on your specific needs and potential challenges, you can select a gateway that not only safeguards transactions but also enhances the overall shopping experience for your customers. What will your choice be?Frequently Asked Questions

What Is A Payment Gateway In E-commerce?

A payment gateway is a service that processes online payments for e-commerce. It securely transfers payment information between the customer, merchant, and bank. In Malaysia, choosing the right payment gateway ensures secure transactions, supporting various payment methods and currencies.

Why Is Security Important In E-commerce Transactions?

Security is crucial because it protects sensitive customer information. A secure payment gateway prevents fraud and builds customer trust. In Malaysia, using a reliable payment gateway with robust security features ensures safe online transactions, enhancing user confidence and business reputation.

How To Choose The Best Payment Gateway In Malaysia?

Choosing the best payment gateway involves assessing security, fees, and supported payment methods. Consider compatibility with your e-commerce platform and customer preferences. In Malaysia, prioritize gateways with strong security protocols and local payment options for a seamless transaction experience.

What Are The Popular Payment Gateways In Malaysia?

Popular payment gateways in Malaysia include iPay88, SenangPay, and MOLPay. These gateways offer secure transactions and support multiple payment methods. They are well-suited for local businesses, providing reliable services and enhancing customer satisfaction through efficient payment processing.

Conclusion

Choosing the right payment gateway is crucial for e-commerce success in Malaysia. It ensures secure transactions. Customers trust businesses that protect their data. Look for gateways that offer strong encryption. Consider the fees and compatibility with your platform. A reliable gateway boosts customer confidence.

This can lead to increased sales. Remember, ease of use is key for both you and your customers. Research options carefully to meet your needs. The right choice helps your business grow. Stay informed about updates and trends in payment security.

Your business and customers will benefit.