Are you considering diving into the world of real estate investment in Malaysia? You’re not alone.

This vibrant market offers promising opportunities, but before you make your first move, it’s crucial to understand the essential licenses and regulations that guide this industry. Imagine having the confidence to navigate the market efficiently, knowing you’re compliant with all the legal requirements.

You’ll discover the key licenses you need and the regulations you must adhere to, ensuring your investments are not only profitable but also secure. We’ll simplify the complex legal landscape, giving you the clarity to make informed decisions. Don’t let uncertainty hold you back from tapping into Malaysia’s thriving real estate sector. Read on to equip yourself with the knowledge that could be the foundation of your successful investment journey.

Real Estate Investment Basics

Real estate investment in Malaysia offers diverse opportunities. It’s a vibrant market with promising returns. To navigate successfully, understanding the basics is crucial. Knowing the essential licenses and regulations can save time and money.

Investing in real estate requires a strategic approach. Begin by researching the market trends. Familiarize yourself with the economic landscape. Recognize the location’s potential for growth.

Legal Framework

Malaysia has a well-defined legal framework for real estate. Investors must comply with various laws. This ensures smooth transactions and protects investments. The National Land Code is a key regulation.

Licenses Required

Specific licenses are needed for real estate activities. Foreign investors often need approval from authorities. The Real Estate and Housing Developers’ Association Malaysia (REHDA) guides developers. Understanding licensing helps in legal compliance.

Investment Strategies

Successful real estate investment involves planning. Diversify your portfolio to minimize risks. Focus on long-term gains rather than quick profits. Evaluate properties thoroughly before purchase.

Market Analysis

Analyzing the market is essential for investors. Study supply and demand trends. Monitor property prices and rental yields. Use this data to make informed decisions.

Understanding Local Culture

Cultural understanding aids in real estate dealings. Respect local customs and practices. Building good relationships with local agents can benefit investments. This fosters trust and smoother transactions.

Financial Management

Managing finances is critical in real estate. Budgeting helps in maintaining cash flow. Understand the taxation laws applicable to property investment. Proper financial planning leads to successful ventures.

Risk Management

Every investment carries risks. Identify potential challenges early. Use insurance to mitigate financial losses. Staying informed can prevent unforeseen issues.

Foreign Investment Rules

Navigating foreign investment in Malaysia’s real estate involves understanding essential licenses and regulations. Investors must obtain approval from the Economic Planning Unit for certain property purchases. Compliance with local guidelines ensures smoother transactions and investment security.

Investing in Malaysian real estate as a foreigner can be an exciting endeavor. However, understanding the rules and regulations is crucial to ensure your investment journey is smooth and rewarding. Malaysia welcomes foreign investors, but there are specific guidelines you need to follow. These rules are designed to maintain the balance between local and international interests. Navigating them might seem daunting, but with clear insights, you can make informed decisions.Foreign Ownership Restrictions

Malaysia allows foreign ownership of property, but there are restrictions. Typically, you can purchase residential properties valued above RM1 million. This ensures that affordable housing remains accessible to locals. Consider if this minimum price aligns with your investment goals. Does it allow you to invest in the type of property you desire?Types Of Properties You Can Purchase

Foreign investors can buy various types of properties, including condominiums, commercial spaces, and industrial properties. Yet, you can’t purchase landed properties like bungalows unless special approval is granted. This rule safeguards local interests and land scarcity. Are you aiming for luxury condos or commercial spaces? Knowing your options can shape your investment strategy.State Regulations And Approvals

Each Malaysian state may have its own rules concerning foreign property ownership. You might need approval from the relevant state authorities, which can take time. Some states are more liberal, while others impose stricter guidelines. Have you considered the regional differences in your investment plan? It could impact your timeline and choice of location.Financing Options For Foreigners

Securing financing in Malaysia as a foreign investor is possible, but it requires a good understanding of local banking procedures. Many banks offer loans to foreigners, but you must meet specific criteria, like having a Malaysian bank account. Are you prepared with the necessary financial documentation? It can streamline your loan application process.Benefits Of Foreign Investment Rules

These regulations are not just hurdles; they offer a structured path for your investment. They ensure the real estate market remains stable and attractive. By adhering to them, you protect your investment and contribute positively to Malaysia’s economy. Have you considered how these rules benefit your long-term investment goals? Understanding them can enhance your strategic planning. Navigating these foreign investment rules might require patience and thorough research. But once you’re equipped with the right knowledge, you can make strategic choices that align with your goals. Are you ready to embark on your Malaysian real estate journey? It’s a vibrant market with potential rewards for those who play by the rules.Types Of Property Ownership

Real estate investment in Malaysia requires understanding property ownership types. Essential licenses and regulations govern these investments. Investors must navigate these to succeed.

Understanding the types of property ownership in Malaysia is crucial. Each type has unique legal implications. These affect how you invest and manage properties. Familiarity with these types can guide your investment strategy. Let’s explore the primary types of property ownership in Malaysia.Freehold Ownership

Freehold ownership is the most straightforward. It offers perpetual ownership of the property. This means the owner has rights indefinitely. Freehold properties are highly sought after. They often have higher market values. Investors prefer them for long-term gains.Leasehold Ownership

Leasehold ownership is limited in time. Typically, it lasts for 99 years. The lease can be renewed upon expiration. Renewal terms depend on government policies. Leasehold properties are often cheaper. They are ideal for short-term investments. Understanding the lease terms is crucial.Strata Title Ownership

Strata title ownership applies to subdivided buildings. It includes apartments and condos. Owners have individual units and shared common areas. This type offers flexibility in urban areas. Strata titles are popular in densely populated regions. They provide a modern living environment.Malay Reserve Land

Malay Reserve Land has specific restrictions. Only Malays can own these properties. This type preserves Malay heritage. It can limit the market for investors. Understanding these laws is essential. It ensures compliance and successful investments. Recognizing these ownership types aids informed decision-making. Each type offers distinct investment opportunities. Choose wisely for your real estate ventures.Restrictions On Foreign Buyers

Malaysia is a popular spot for real estate investment. Its vibrant economy and stunning landscapes attract many foreign investors. But there are rules for foreign buyers. These rules ensure local citizens have access to property. They also maintain control over national assets.

Foreigners can buy property, but they face restrictions. These rules vary depending on the region. Understanding these restrictions is crucial for potential buyers. It helps in avoiding legal issues.

Minimum Property Price

Foreign buyers must adhere to a minimum property price. This price varies between states. In Kuala Lumpur, the minimum is RM1 million. Other states may have different minimums. This rule ensures foreigners buy high-value properties. It protects local buyers from high prices.

Types Of Property Available

Not all properties are available to foreign buyers. They cannot purchase properties on Malay Reserve Land. Agricultural properties are also off-limits. Foreigners can buy apartments and condos. They can also purchase commercial properties. But approval from state authorities is necessary.

Special Approvals Required

Foreign buyers need special approvals. These approvals come from the state authority. The process can be lengthy. It involves several checks and balances. This ensures the buyer’s intentions align with local regulations.

State-specific Regulations

Each Malaysian state has unique rules. Some states are more lenient. Others have stricter guidelines. Researching these rules is important. It helps in making informed decisions. Engaging a local lawyer can be beneficial.

Investment Incentives And Exceptions

Malaysia offers incentives to foreign investors. Some projects have relaxed rules. These projects often boost the local economy. Foreigners should explore these opportunities. It could provide an easier entry into the market.

State Authority Approvals

State Authority Approvals play a vital role in real estate investment in Malaysia. Investors need to understand these approvals to ensure smooth transactions. The state authorities in Malaysia oversee land matters and property transactions. They ensure compliance with local regulations.

Understanding State Authority Approvals

State authority approvals vary across Malaysia’s different states. Each state has its own rules for land usage and property development. Investors must familiarize themselves with these rules before proceeding.

Why Are State Authority Approvals Necessary?

These approvals ensure the property adheres to local development plans. They protect the interests of the community and environment. Without them, investments may face legal challenges.

Types Of State Authority Approvals

Common approvals include planning permission and building permits. Planning permission assesses the property’s impact on the surrounding area. Building permits ensure construction meets safety standards.

Steps To Obtain State Authority Approvals

Investors should begin by consulting local planning departments. Submit necessary documents for review. Follow up regularly to check on approval status.

Potential Challenges In Obtaining Approvals

Delays may occur due to incomplete documentation. There may be conflicts with local land use policies. Investors should prepare for these challenges to avoid setbacks.

Tips For Navigating State Authority Approvals

Engage with local experts who understand the approval process. Maintain clear communication with state authorities. Ensure all documentation is complete and accurate.

Real Property Gains Tax

Real Property Gains Tax (RPGT) is crucial for real estate investors in Malaysia. This tax applies when selling property at a profit. Understanding RPGT helps investors plan better. It affects your investment returns significantly.

What Is Real Property Gains Tax?

RPGT is a tax on profits from selling property. It ensures fair revenue distribution from real estate gains. The tax rate depends on the property’s holding period. Shorter holding periods often mean higher tax rates.

Rpgt Rates And Holding Periods

The RPGT rate varies based on how long you own the property. For properties sold within the first three years, the rate is highest. It decreases as the holding period increases. This encourages long-term investment in real estate.

Exemptions And Reliefs In Rpgt

Certain exemptions exist under RPGT. One exemption is for the sale of a private residence. Each person can claim this exemption once in their lifetime. There are also reliefs for losses incurred from property sales.

Calculating Rpgt For Your Investment

To calculate RPGT, deduct the acquisition price from the selling price. Then apply the relevant RPGT rate to the profit. Ensure you keep records of all related expenses. This can help reduce your taxable gains.

Importance Of Rpgt Knowledge For Investors

Understanding RPGT helps in strategic property investment. It impacts your overall profit from real estate. Planning ahead can save you money. Being informed about RPGT is vital for successful investment.

Stamp Duty Regulations

Stamp duty regulations play a vital role in Malaysia’s real estate investment. Investors must understand these taxes to manage costs. Essential licenses ensure legal compliance and smooth transactions.

Navigating the landscape of real estate investment in Malaysia requires an understanding of various licenses and regulations. Among these, stamp duty regulations are crucial. They can significantly impact your investment’s cost and, by extension, your returns. Knowing how to handle stamp duty can save you money and streamline your investment process.What Is Stamp Duty?

Stamp duty is a tax imposed on legal documents, typically in the transfer of property. In Malaysia, it’s essential for you to consider this cost when purchasing real estate. The duty varies based on the property’s value, and understanding this can help you plan your investment budget better.Current Stamp Duty Rates In Malaysia

Stamp duty rates in Malaysia are tiered. For properties valued up to RM100,000, the duty is 1%. Between RM100,001 and RM500,000, it’s 2%. For properties over RM500,000, the rate is 3%. Knowing these rates allows you to calculate your costs accurately.Exemptions And Reliefs

Are there ways to reduce stamp duty? Yes, there are exemptions and reliefs available. First-time homebuyers, for example, may qualify for stamp duty exemptions. It’s wise to check if any current policies offer reliefs that could benefit you.Process Of Paying Stamp Duty

Paying stamp duty involves a few steps. You’ll typically pay this tax when you sign the Sale and Purchase Agreement. It’s crucial to ensure that all documents are correctly stamped to avoid legal complications. A real estate lawyer can be a valuable ally in this process.Impact On Investment

How does stamp duty affect your investment? It’s not just an extra cost. It affects your cash flow and investment returns. As a smart investor, factoring in these expenses early can lead to more accurate financial planning and better investment decisions.Personal Insights On Stamp Duty

Reflecting on my experience, I once underestimated stamp duty costs, which affected my investment’s profitability. This oversight taught me the importance of thorough research and planning. Have you ever overlooked a crucial detail like this? It’s a learning opportunity that reminds us to consider every aspect of an investment. Understanding stamp duty regulations is not just about complying with the law—it’s about optimizing your investments. By knowing the rates, exploring exemptions, and planning for these costs, you can make informed decisions that enhance your real estate ventures in Malaysia.

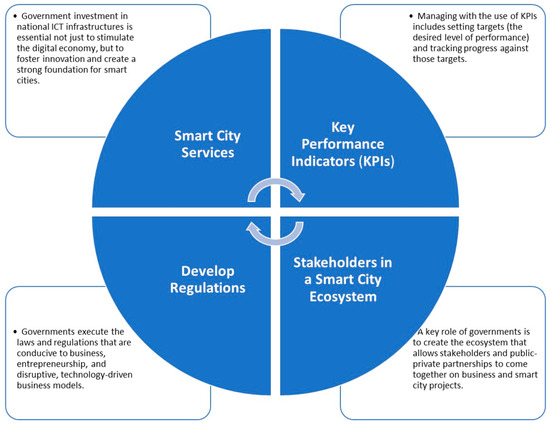

Credit: www.mdpi.com

Property Valuation Guidelines

Property valuation is crucial for real estate investment in Malaysia. Accurate valuations guide informed decisions, ensuring investments are worthwhile. Understanding guidelines helps investors navigate the market with confidence.

Importance Of Accurate Valuation

Accurate property valuation prevents financial loss. It offers a clear picture of potential profits. Investors rely on precise data to assess market value. This helps in making strategic buying or selling decisions.

Factors Influencing Property Valuation

Several factors affect property valuation in Malaysia. Location plays a significant role. Properties in urban areas often have higher values. The condition of the property impacts the valuation. Well-maintained properties attract better offers.

Regulatory Guidelines For Valuation

Malaysia has specific guidelines for property valuation. These ensure transparency and fairness. Guidelines are set by authorities like the Valuation and Property Services Department. Compliance with these rules is essential for accurate assessments.

Role Of Professional Valuers

Professional valuers are key to accurate assessments. They have expertise in analyzing market trends. Valuers adhere to regulatory standards. Their evaluations provide trustworthy data for investors.

Valuation Reports And Their Significance

Valuation reports are comprehensive documents. They detail the property’s market value. Investors use these reports to make informed decisions. Reports serve as official records for transactions.

Impact On Investment Strategies

Valuation affects investment strategies significantly. Accurate data helps in risk management. It aids in identifying lucrative opportunities. Investors adjust strategies based on valuation insights.

Building And Construction Permits

Navigating Malaysia’s real estate market requires understanding essential licenses and regulations. Building and construction permits ensure projects comply with safety standards. Investors must secure these permits for legal and successful property development.

Navigating the world of real estate investment in Malaysia can be thrilling yet challenging. One crucial aspect you must grasp is the realm of building and construction permits. These permits ensure that your investment complies with Malaysia’s regulations, safeguarding both your interests and the community’s well-being. Whether you’re constructing a new property or renovating an existing one, understanding the necessary permits can save you time, money, and potential legal troubles.Understanding Building Permits

Building permits are essential for any construction project. They confirm that your plans meet local building codes and safety standards. Without them, you risk facing hefty fines or being forced to halt your project. Imagine investing heavily in a property only to discover you can’t proceed due to missing permits. Such a situation can be both frustrating and costly.Steps To Obtain A Building Permit

Securing a building permit involves several steps. Initially, you need to submit detailed architectural plans to the local authority. These plans should outline every aspect of your project. After submission, expect a thorough review process. Local authorities will assess whether your project aligns with zoning laws and environmental guidelines. Patience is key here, as approval can take weeks or even months.Common Challenges In The Permit Process

The journey to obtaining a building permit is not always smooth. One common hurdle is navigating the bureaucracy of local authorities. You might encounter unclear guidelines or face delays due to administrative backlogs. Additionally, any discrepancies in your submitted plans can lead to rejection. To mitigate these issues, consider hiring a local consultant or architect familiar with Malaysian regulations. Their expertise can streamline the process, saving you time and stress.Importance Of Compliance

Compliance with building regulations is not just a legal requirement; it’s a commitment to quality and safety. Non-compliance can lead to structural issues or safety hazards, affecting the property’s value and marketability. Think about the long-term implications. Would you buy a property with a questionable safety record? Adhering to regulations ensures your investment retains its appeal and integrity.Leveraging Technology In Permit Applications

Technology can be your ally when applying for building permits. Many local councils in Malaysia offer online portals for submissions and tracking progress. This digital approach can accelerate the process and reduce paperwork. It also provides a transparent way to monitor your application’s status, keeping you informed every step of the way. Understanding and obtaining the right building and construction permits is a vital step in your real estate investment journey in Malaysia. Are you ready to take the plunge with confidence? Equip yourself with the right knowledge and resources, and make your investment a successful venture.

Credit: www.instagram.com

Environmental Compliance

Environmental compliance is crucial in real estate investment in Malaysia. It ensures sustainable development and protects natural resources. Investors must understand environmental regulations to avoid legal issues and enhance property value. This section covers essential aspects of environmental compliance in real estate.

Understanding Environmental Impact Assessments (eia)

EIA evaluates potential environmental effects of a proposed project. It helps identify risks before development begins. Malaysian law requires EIA for certain projects. The assessment ensures projects align with environmental standards. It protects ecosystems and communities.

Water And Air Quality Regulations

Maintaining water and air quality is vital. Real estate projects must adhere to regulations. Malaysia monitors pollution levels to safeguard health and nature. Compliance includes controlling emissions and waste management. Investors should prioritize sustainable practices.

Waste Management And Recycling Requirements

Proper waste management is essential. Regulations mandate waste disposal and recycling procedures. Real estate developers must follow these guidelines. It reduces environmental impact and promotes sustainability. Efficient waste management contributes to a cleaner environment.

Preservation Of Natural Habitats

Protecting natural habitats is key. Real estate projects must respect wildlife areas. Regulations prevent destruction of vital ecosystems. Developers should integrate nature-friendly designs. It fosters biodiversity and maintains ecological balance.

Renewable Energy Incentives

Embracing renewable energy is encouraged. Malaysia offers incentives for green energy use. Real estate projects benefit from solar and wind power integration. It reduces reliance on non-renewable sources. Sustainable energy enhances property appeal.

Zoning Laws And Regulations

Understanding zoning laws and regulations is crucial for real estate investment in Malaysia. These laws dictate what can be built and where. They ensure that developments suit the surrounding environment. Investors must know these rules to avoid costly mistakes.

What Are Zoning Laws?

Zoning laws organize land into sections for specific uses. These uses include residential, commercial, and industrial. Each zone has its own rules and restrictions. These laws help create balanced urban development.

Importance Of Zoning Laws In Real Estate

Investors must comply with zoning laws. They protect property value and community welfare. Ignoring them can lead to penalties. This can affect the investment’s success.

How To Check Zoning Regulations

Visit the local municipal office to check zoning regulations. They provide maps and documents. These resources show the zoning status of the property. Online portals might also offer this information.

Common Zoning Challenges

Sometimes, zoning laws change. This can affect existing properties. Investors face challenges if their plans conflict with new regulations. Understanding potential changes is important.

Seeking Professional Guidance

Consulting a local expert can be helpful. They understand the zoning landscape. They provide advice on navigating complex regulations. This can save time and prevent costly errors.

Financing And Loan Regulations

Real estate investment in Malaysia requires understanding essential licenses and regulations. Investors must comply with financing and loan rules. These regulations ensure smooth property transactions and protect both buyers and sellers.

Investing in real estate in Malaysia can be a profitable venture. However, understanding the intricacies of financing and loan regulations is crucial. Navigating these regulations not only ensures compliance but can also significantly impact your return on investment. Let’s dive into the key aspects you need to be aware of.Understanding Loan Types

Malaysia offers various loan options tailored for real estate investors. From fixed-rate loans to variable-rate loans, each has its advantages. Fixed-rate loans provide stability, helping you budget effectively without worrying about fluctuating interest rates. On the other hand, variable-rate loans can offer lower initial rates, potentially saving you money if market conditions remain favorable.Eligibility Criteria For Loans

To qualify for a real estate loan in Malaysia, you must meet specific criteria. Lenders look at your credit score, income level, and debt-to-income ratio. These factors determine your ability to repay the loan. If you’re a foreign investor, additional requirements such as a valid visa and proof of income from your home country might be necessary. Understanding these criteria can help you prepare better and increase your chances of loan approval.Government Regulations On Financing

The Malaysian government has regulations in place to protect both investors and lenders. For instance, the Loan-to-Value (LTV) ratio restricts the amount you can borrow relative to the property’s value. This measure helps prevent over-leveraging, ensuring you don’t take on more debt than you can handle. Staying informed about these regulations can guide your investment strategy and prevent legal hassles.Tips For Securing The Best Loan Rates

Securing a favorable loan rate can make a big difference in your investment’s profitability. Start by shopping around and comparing rates from different banks. Building a strong relationship with your lender can also be beneficial. They may offer you better terms if they understand your financial situation and investment goals. Additionally, maintaining a high credit score often leads to lower interest rates, saving you money in the long run.Personal Insights On Financing Strategies

When I first invested in Malaysian real estate, I underestimated the importance of choosing the right loan type. Opting for a variable-rate loan seemed attractive due to its lower initial rate. However, unexpected changes in the market increased my monthly payments, affecting my cash flow. This experience taught me the value of stability, and now I prefer fixed-rate loans, even if they start higher. What loan type aligns best with your investment strategy? Understanding these financing and loan regulations can significantly impact your real estate investment journey in Malaysia. Are you prepared to navigate these regulations effectively?Land Acquisition Process

Investing in real estate in Malaysia offers promising opportunities. Understanding the land acquisition process is vital. This process involves several legal steps and regulations. Investors must navigate these to ensure compliance. Let’s explore the essential steps involved in acquiring land in Malaysia.

Legal Requirements For Land Acquisition

The first step is understanding legal requirements. Foreign investors must get approval from the relevant authorities. They need to adhere to local laws and regulations. Obtaining the necessary permits is crucial. It ensures the legality of the investment.

Types Of Land Ownership

Malaysia offers different types of land ownership. Freehold land provides permanent ownership. Leasehold land allows ownership for a set period. Understanding these differences is important. It affects the duration and terms of ownership.

Documentation And Application Process

Proper documentation is key to acquiring land. Investors must prepare legal documents. These include identity verification and financial proofs. Applications must be submitted to the land office. Accurate submission ensures smooth processing.

Approval From The State Authority

State authority approval is essential for foreign investors. They must seek permission for land acquisition. The approval process may take time. It’s important to plan accordingly. Successful approval enables further investment steps.

Tax Implications

Investors should be aware of tax implications. Land acquisition involves taxes like stamp duty. Understanding these costs is important. Proper tax planning can save money. Consult with tax experts for guidance.

Environmental Considerations

Environmental regulations play a role in land acquisition. Ensuring compliance with these is important. Projects may require environmental impact assessments. This ensures sustainable development. It helps protect natural resources.

Credit: www.mdpi.com

Tenancy And Lease Laws

When investing in real estate in Malaysia, understanding tenancy and lease laws is crucial. These laws govern the rights and responsibilities of landlords and tenants, ensuring fair and efficient rental agreements. Knowing these regulations can protect your investment and enhance your rental experience.

Understanding Tenancy And Lease Agreements

Tenancy agreements are vital documents in real estate transactions. They outline terms such as rent amount, payment frequency, and duration of tenancy.

Lease agreements, often used for longer rental periods, specify conditions for property use and tenant obligations. Ensuring clarity in these documents prevents misunderstandings.

Imagine renting out your first property. You assume the tenant will pay on time and care for the space. Without a clear lease agreement, disputes can arise, affecting your investment.

Key Components Of A Lease Agreement

A well-drafted lease agreement should include several essential components:

- Rental amount and payment terms

- Property maintenance responsibilities

- Termination conditions and notice periods

- Security deposit details

Consider adding a clause for regular property inspections. This ensures the tenant maintains the property, safeguarding your investment.

Tenancy Duration And Renewal Processes

Tenancy duration impacts rental income stability. Short-term leases offer flexibility, but long-term leases ensure consistent income.

Renewal processes should be straightforward. Include clear terms for renewal notice periods and rent adjustments. This helps maintain positive landlord-tenant relationships.

If tenants feel uncertain about renewal terms, they may opt to move out, causing you potential loss of rental income.

Legal Implications Of Lease Violations

Lease violations can lead to legal challenges. Common issues include non-payment of rent, damage to property, or unauthorized subletting.

Address violations swiftly to minimize impact. Document all communications and actions taken to ensure legal protection.

Imagine a tenant subletting your property without consent. This can lead to overcrowding, increased wear and tear, and potential legal disputes. A proactive approach can prevent such issues.

Navigating Eviction Procedures

Eviction is a sensitive process requiring adherence to specific legal protocols. It’s crucial to follow proper procedures to avoid complications.

Ensure your lease agreement includes clear eviction terms. Always consult legal professionals when initiating eviction to ensure compliance with Malaysian law.

Have you ever wondered what happens if you need to evict a tenant for non-payment? Missteps in eviction can result in prolonged legal battles, affecting your property’s profitability.

Understanding tenancy and lease laws in Malaysia is not just about compliance. It’s about building a successful real estate investment strategy. Equip yourself with knowledge to protect your assets and enhance your rental experience.

Anti-money Laundering Requirements

Real estate investors in Malaysia must comply with strict anti-money laundering regulations. Essential licenses ensure transparency and safeguard against financial crimes. These requirements protect both the investors and the integrity of the property market.

Navigating the world of real estate investment in Malaysia requires more than just understanding market trends and property values. One crucial aspect often overlooked by investors is ensuring compliance with Anti-Money Laundering (AML) regulations. These regulations are designed to prevent the illegal laundering of money through real estate transactions. As an investor, understanding and adhering to these requirements is not just a legal obligation but a smart business move. In Malaysia, the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA) plays a pivotal role in safeguarding the financial system from being misused.Understanding Amla

AMLA requires real estate agents and investors to conduct due diligence on their clients. This means verifying the identity of buyers and sellers. You must ensure that funds used in transactions are legitimate.Customer Due Diligence (cdd)

Customer Due Diligence is a key component of AML compliance. This process involves collecting information about your clients. It also includes assessing the risk of money laundering.Record Keeping

Under AML regulations, you’re required to maintain detailed records of all transactions. This includes copies of identification documents and transaction details. Keeping accurate records can protect you from legal issues.Suspicious Transaction Reporting

If you suspect a transaction is linked to illegal activities, you must report it to the relevant authorities. Failure to report suspicious transactions can lead to severe penalties. This not only safeguards your business but also supports national security.Training And Awareness

Staying informed about AML regulations is crucial. Regular training for you and your team ensures compliance. Awareness helps in identifying and preventing money laundering activities.Practical Steps For Compliance

To comply with AML regulations, implement a robust compliance program. Regularly update your knowledge and systems. Engage professionals if needed to ensure you’re on the right track. Have you ever wondered how a small oversight could cost you dearly in your real estate venture? Ensuring compliance with AML requirements not only protects your investment but also enhances your reputation in the market. Embrace these regulations as a cornerstone of your business strategy, and you’ll not only safeguard your assets but also contribute to a more secure financial ecosystem in Malaysia.Real Estate Agency Licensing

Real estate investment in Malaysia requires understanding the licensing process. The Malaysian government has clear guidelines for real estate agencies. This ensures professionalism and protects investors.

Understanding The Licensing Body

The Board of Valuers, Appraisers, Estate Agents and Property Managers (BOVAEA) regulates the industry. BOVAEA ensures all real estate agents meet the required standards. They oversee licensing and maintain a registry of licensed agents.

Requirements For Licensing

Aspirants must complete specific educational courses. They must pass exams and gain practical experience. This process ensures agents have the necessary skills and knowledge.

The Role Of Real Estate Agents

Licensed agents assist in buying, selling, and managing properties. They offer expert advice and ensure compliance with legal requirements. This guidance is invaluable for investors.

Benefits Of Hiring Licensed Agents

Licensed agents offer credibility and legal protection. They provide accurate information and negotiate favorable deals. Their expertise minimizes risks in property transactions.

Penalties For Unlicensed Practice

Operating without a license is illegal. Offenders face fines and imprisonment. This strict enforcement protects investors and maintains industry standards.

Tax Incentives For Investors

Exploring real estate in Malaysia requires understanding essential licenses and regulations. Tax incentives attract investors, offering benefits that enhance profitability. Navigating legal frameworks ensures compliance and maximizes investment opportunities.

Investing in real estate in Malaysia presents an exciting opportunity, particularly with the tax incentives available to investors. These incentives can significantly enhance your returns and make the real estate landscape even more appealing. Understanding these benefits can be the key to maximizing your investments in Malaysia.What Tax Incentives Are Available?

Malaysia offers several tax incentives to attract real estate investors. One of the main attractions is the Real Property Gains Tax (RPGT), which applies to profits from selling properties. However, the rates decrease over time, encouraging longer-term investments. Additionally, certain properties, especially those in economic corridors like Iskandar Malaysia, may qualify for additional tax breaks.How Do These Incentives Benefit You?

These incentives reduce the financial burden on investors. By paying less tax, you have more capital to reinvest in other properties or upgrades. This approach can accelerate your wealth-building journey. Imagine being able to reinvest the savings from lower tax payments into another property, thus expanding your portfolio more quickly.Are There Any Conditions?

While the incentives are attractive, they come with specific conditions. For example, the RPGT rates vary based on how long you’ve held the property. Properties sold within the first five years are taxed at higher rates compared to those held longer. It’s crucial to plan your investment timeline carefully to take full advantage of the reduced rates.Personal Experience: Navigating Tax Incentives

When I first invested in Malaysia, understanding the tax incentives felt overwhelming. However, consulting with a local tax advisor made a world of difference. They helped me strategize my investments to align with the tax incentives, ultimately saving me a significant amount. Have you considered seeking expert advice to navigate these incentives effectively? Understanding and leveraging tax incentives can be a game-changer for your real estate investments in Malaysia. Whether you’re a seasoned investor or just starting out, these benefits can help you maximize your returns and grow your property portfolio strategically. Are you ready to make the most of what Malaysia has to offer?Legal Framework For Real Estate

Real estate investment in Malaysia requires understanding the legal framework. Navigating the laws and regulations is crucial. Investors must comply with several legal requirements. This ensures smooth transactions and protects their investments.

Understanding Property Ownership Laws

Malaysia has distinct property ownership laws. Foreigners can own property but with restrictions. Certain properties are reserved for Malaysian citizens. Understanding these laws helps investors make informed decisions.

Regulations For Foreign Investors

Foreign investors face specific regulations in Malaysia. Approval from the Economic Planning Unit is needed for certain transactions. There are minimum property value thresholds for foreign ownership. These regulations ensure fair market practices.

Land Acquisition Act

The Land Acquisition Act governs property transactions. It outlines the process for acquiring land legally. This act protects both buyers and sellers. It ensures transparency and fairness in property dealings.

Real Estate Tax Regulations

Understanding tax regulations is vital for real estate investors. Malaysia imposes real property gains tax on property sales. Stamp duties also apply to property transactions. Awareness of these taxes helps in financial planning.

Building And Construction Codes

Investors must adhere to building codes and standards. These codes ensure safety and quality in construction. Compliance is mandatory for all real estate developments. Proper adherence prevents legal issues and penalties.

Environmental Regulations

Environmental regulations impact real estate projects. Developers must conduct environmental assessments. This ensures projects do not harm the environment. Compliance with these regulations is necessary for project approval.

Role Of Legal Experts

Legal experts play a key role in real estate transactions. They provide guidance on legal requirements. Their expertise helps navigate complex regulations. Hiring legal professionals ensures legal compliance and risk management.

Cross-border Property Transactions

Cross-border property transactions in Malaysia offer exciting investment opportunities. As an investor, understanding the regulations is vital. It ensures a smooth transaction process. Malaysia’s property market attracts foreign investors due to its strategic location. Yet, engaging in cross-border transactions requires careful navigation. This involves compliance with various legal requirements. Knowing these is essential for successful real estate investment.

Understanding Foreign Ownership Regulations

Foreigners can own property in Malaysia, but there are rules. Residential property must meet a minimum purchase price. This varies by state, often starting at RM1 million. Commercial properties have different regulations. Knowing these details helps in planning your investment.

Necessary Documents For Cross-border Transactions

Investors need specific documents to proceed. A Sale and Purchase Agreement (SPA) is crucial. A lawyer usually drafts this document. Also, a Foreign Investment Committee (FIC) approval might be necessary. This depends on the property type and location. Proper documentation ensures a legal transaction.

Legal Assistance And Advisory Services

Engaging a local lawyer is advisable. They provide insights into the legal landscape. Lawyers help with document preparation and compliance. Advisory services offer guidance on market trends. They assist in making informed investment decisions.

Currency Exchange And Payment Considerations

Currency exchange is a key consideration. Understanding exchange rates is crucial. It impacts the overall investment cost. Foreign investors often use international banks for transactions. This ensures secure and efficient payment processes.

Tax Obligations For Foreign Investors

Foreign investors face specific tax obligations. Real Property Gains Tax (RPGT) applies to property sales. Understanding tax laws aids in financial planning. Consulting a tax expert can provide clarity. This helps in managing investment returns effectively.

Cross-border property transactions in Malaysia require thorough preparation. Knowing the rules and regulations is essential. This ensures a successful investment journey.

Future Trends In Regulations

Navigating Malaysia’s real estate market requires understanding essential licenses and regulations. Future trends may introduce new compliance measures. Investors must stay informed to ensure smooth transactions and legal investments.

The real estate investment landscape in Malaysia is constantly evolving, and staying ahead of regulatory changes is crucial for investors. As the industry adapts to technological advancements and shifting economic conditions, understanding future trends in regulations can help you make informed decisions. These trends could impact your investment strategy and shape the market’s future.Technological Integration In Regulations

As technology becomes more ingrained in the real estate sector, expect regulations to reflect this shift. Digital platforms for property transactions are gaining popularity. Authorities might soon standardize digital contracts and signatures. This could streamline processes and reduce paperwork.Environmental Sustainability Requirements

Malaysia is moving towards greener policies. You might see stricter environmental regulations for new developments. If you’re investing, consider properties with eco-friendly features. This trend could affect property values and attract environmentally-conscious buyers.Foreign Investment Regulations

Malaysia is a hotspot for foreign investors. Regulations may tighten or relax based on economic conditions. Keep an eye on changes that affect foreign ownership or taxes. Understanding these shifts can help you navigate and seize opportunities in the market.Data Privacy And Security

With more online transactions, data privacy is a growing concern. Regulations might soon require stricter data protection measures. Ensure your investment complies with these standards to avoid legal issues. Secure handling of client data could become a key differentiator in the market.Impact Of Global Economic Policies

Global economic changes can influence local regulations. Trade agreements or geopolitical shifts might impact investment laws. How prepared are you for these changes? Staying informed can help you adapt your strategy to mitigate risks and capitalize on new opportunities.Adaptive Strategies For Investors

How do you plan to adapt to these regulatory changes? Investors who are flexible and proactive will thrive. Regularly update your knowledge on regulations. Collaborate with experts to ensure compliance and optimize your investment strategy. Navigating these future trends in regulations can be challenging. But being proactive and informed can turn potential hurdles into opportunities. As you plan your next investment, consider how these regulatory shifts might affect your strategy. Are you ready to embrace these changes and make them work in your favor?Frequently Asked Questions

What Licenses Are Needed For Real Estate Investment In Malaysia?

To invest in real estate in Malaysia, you need a Real Estate Negotiator (REN) license. Additionally, foreign investors must obtain approval from the Economic Planning Unit (EPU) for property purchases. Compliance with local authority regulations is also essential for successful investment.

How Do Foreign Investors Buy Property In Malaysia?

Foreign investors must obtain approval from the Economic Planning Unit (EPU) for property purchases. They are allowed to buy properties above RM1 million. It’s important to adhere to local regulations and engage a licensed real estate agent for guidance.

Are There Restrictions On Foreign Ownership In Malaysia?

Yes, foreign ownership in Malaysia is subject to certain restrictions. Foreigners can only purchase properties priced above RM1 million. Approval from the Economic Planning Unit (EPU) is mandatory. These regulations ensure a balanced real estate market and protect local interests.

What Are The Tax Implications For Property Investment?

Property investment in Malaysia involves several taxes. These include Real Property Gains Tax (RPGT), Stamp Duty, and Income Tax on rental income. Understanding these taxes is crucial for financial planning and compliance. Consulting a tax advisor is recommended for accurate tax management.

Conclusion

Navigating Malaysia’s real estate laws is crucial for investors. Understanding licenses and regulations ensures smooth transactions. Compliance protects your investments and boosts credibility. Always stay informed about legal updates. Seek expert advice to avoid pitfalls. A sound understanding saves time and money.

Real estate investment holds great potential in Malaysia. Proper preparation is key to success. Equip yourself with knowledge and confidence. Make informed decisions and thrive in this dynamic market.