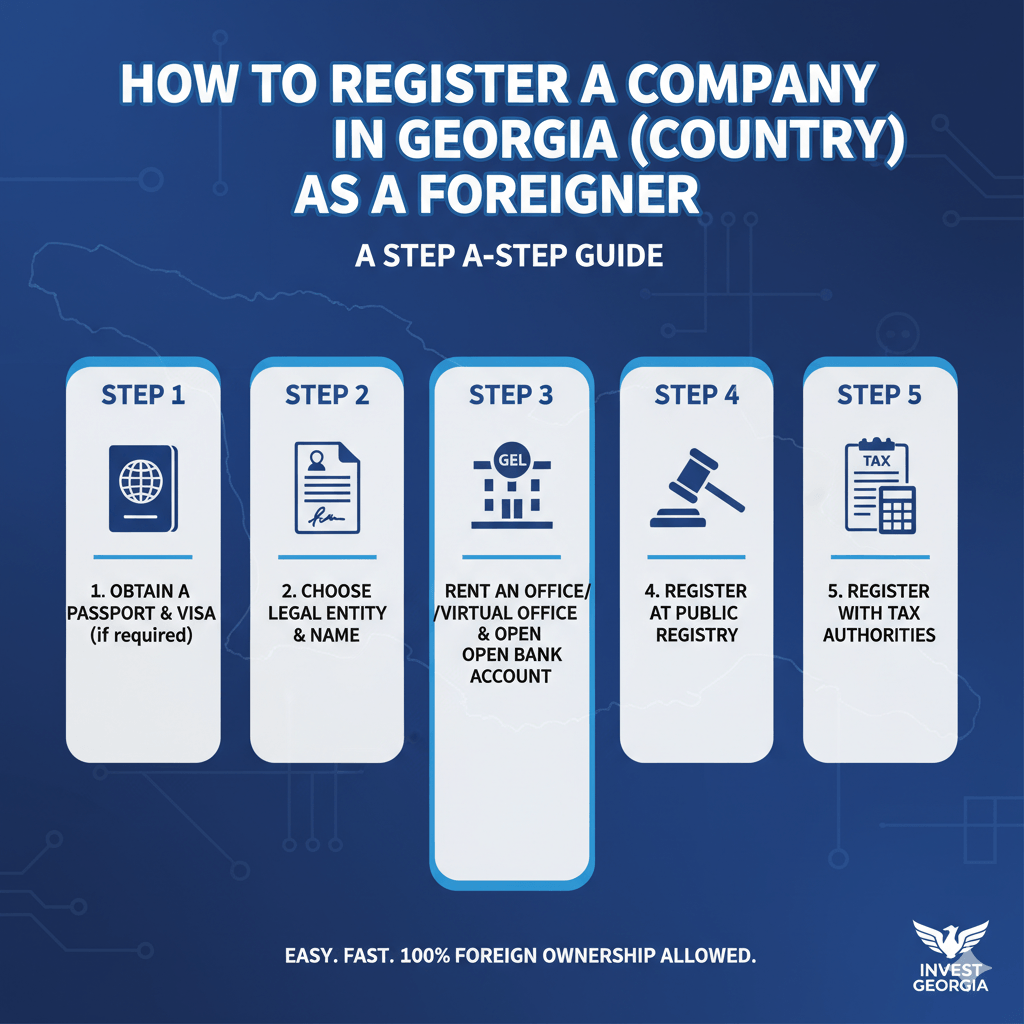

Georgia (Sakartvelo) is one of the easiest places in Europe to start and run a business as a non-resident. You can own 100% of your company, register quickly, and access friendly tax regimes (including a 1% turnover option for qualifying small businesses). Here’s a practical, step-by-step guide—plus the ready-to-use marketing content you shared woven into the right sections.

Georgia at a glance (why founders pick it)

- 100% foreign ownership across common structures (LLC, IE/sole proprietor, branch/rep office).

- Fast registration at the National Agency of Public Registry (NAPR) / Public Service Hall—often completed the same day for simple cases; end-to-end setup (translations, bank, address) typically 15–20 business days.

- Simple verification: you can search entities in the Entrepreneurial & Non-Entrepreneurial Registry online.

- Attractive taxes:

- Companies: 15% on distributed profits (Estonian CIT model; reinvested profits untaxed until distribution).

- Individuals (IE) with Small Business Status (SBS): 1% on turnover up to 500,000 GEL (conditions apply).

- VAT 18%; registration generally required once VAT-able turnover exceeds 100,000 GEL in any rolling 12 months.

From your promo: “Only 1% business tax,” “Global banking,” “One of the easiest legal pathways to Europe.” These are accurate when framed correctly—the 1% rate applies to Individual Entrepreneurs with Small Business Status and subject to eligibility; companies use the 15% distributed-profits model. We’ve reflected that nuance below with sources.

Step 1 — Choose your structure

Most foreign founders pick one of these:

- LLC (Limited Liability Company)

- Flexible, limited liability, suitable for most commercial activities.

- Registration with NAPR/Public Service Hall; tax number assigned automatically at registration.

- IE – Individual Entrepreneur (sole proprietor)

- Light compliance; option to apply for Small Business Status (SBS) for the 1% regime if eligible.

- Often used by freelancers/consultants/solo operators.

- Branch or Representative Office of a foreign company

- Useful if you want Georgian presence without a separate subsidiary. Registered by NAPR.

Tip: If you plan to pursue TRC (Temporary Residence Card) via business, an LLC with genuine activity is a common route. (IE may also work depending on your case.)

Step 2 — Prepare your documents

- Passport (original + copy).

- Company charter (for LLC) & basic details (name, address, director).

- If any documents are issued abroad (e.g., PoA, parent-company docs for a branch), expect apostille/legalization and notarized Georgian translation.

Step 3 — Register at the Public Service Hall (NAPR)

- Go to a Public Service Hall in Tbilisi/Batumi (or appoint a rep with PoA).

- Submit the application; state & tax registration are combined.

- For simple cases, confirmation can be the same/next business day.

You can later verify your company on the official online registry.

Step 4 — Open a Georgian bank account

- Banks will do standard KYC (passport, company extract, activity description).

- Expect to show contracts/invoices/lease if applying for TRC via business later; real activity matters.

Step 5 — Pick your tax posture & register extras (if needed)

- LLC: falls under 15% CIT on distributed profits (Estonian model).

- IE: after registering, apply for Small Business Status if you qualify (1% on turnover up to 500,000 GEL; certain professions excluded/limited).

- VAT: register once the 100,000 GEL threshold is crossed (or voluntarily). Rate 18%.

Step 6 — Immigration pathway (D-Visa & TRC )

Who needs a visa first?

If you are visa-free for 1 year, you can enter Georgia and apply for TRC from inside Georgia. Otherwise, you’ll typically get a D-category visa via the Georgian consular portal and then apply for TRC in Georgia.

Where to apply for TRC

All first-time TRC applications are filed inside Georgia at the Public Service Hall (PSH). Expedited timelines (10/20/30 calendar-day decisions) are available for higher state fees.

Typical evidence for Business TRC

- Active Georgian entity (LLC/IE),

- Proof of real business activity (contracts, invoices, office lease, bank statements/turnover),

- Tax compliance.

Standard initial TRC validity is 6–12 months, extendable; permanent residency is generally possible after longer lawful residence.

Practitioner note: Many advisors aim to evidence ~50,000 GEL annual turnover per foreign applicant to strengthen a business-based TRC case (a practical benchmark—not a universal statutory rule).

Your content, integrated — our managed TRC flow

- Company registration

- Open Georgian bank account

- Bank balance confirmation 50,000 GEL for 1 day (your internal, fully managed step to support documentation—this is not an official legal requirement)

- Start activity & compile evidence

- Apply for TRC at PSH

- Approx. 30-day standard decision window (expedite available)

Costs, timing & realistic timeline

- Core registration can be done same/next day; IE setup is often “under a day,” while an LLC with translations, apostilles, banking, and address setup typically takes 15–20 business days.

- TRC decision timelines: 10/20/30 days (higher fee for faster review).

Compliance quick-start

- Accounting & filings: Even with Estonian CIT, keep books, issue invoices, and file required returns.

- VAT: Register at 100,000 GEL VAT-able turnover; file monthly once registered.

- SBS (1%): applies to IEs only; confirm eligible activities and keep turnover within limits.

Living, family & opportunity (your promo sections)

💎 Why Georgia – Your Best Choice

- 100% foreign ownership; 20–30 business days typical end-to-end setup; global banking access; low-friction pathway to operate across Europe. (See tax & speed notes and sources above.)

🕌 Extra Benefits for Muslim Families

Halal options, mosques/centers, family-friendly areas, and Islamic education opportunities.

🎓 Education & Study

International schools (IB/Cambridge) and affordable universities/master’s programs.

🏡 Living Cost (estimates)

Rent: $250–$500 | Food: $150–$250 | Utilities: $50–$80 → $500–$900/month (comfortable).

💼 Profitable Business Opportunities

IT & Digital Services • Tourism/Hotels/Airbnb • Import/Export • Real Estate • Student Consultancy • International Business Setup

Packages (All-inclusive; written agreements; no hidden charges)

| Package | Price (EUR) | What’s included |

|---|---|---|

| ✨ Economy | €6,000 | Basic setup, legal address, bank account, TRC support |

| ⚡ Standard | €7,300 | Economy + D-visa documents, follow-up support, standard processing |

| 👑 VIP | €9,500 | Full A–Z premium service, fast-track process, complete legal support, website/IT support, priority handling |

Why start now?

Affordable & secure gateway to Europe • Fast process—begin TRC within ~30 days • Secure your family, business, and future.

Disclaimer:

We are a private consultancy agency providing business setup and immigration support services in Georgia. We are not a government authority or official immigration office. All services are offered under agency agreements, and clients are advised to verify requirements with the relevant Georgian authorities.

📞 Contact Us

ZattWorldSolutions – We Connect Possibilities

📧 Email: director@zattworldsolutions.com

🌐 Website: https://zattworldsolutions.com/contact-us/

🌍 Locations: Bangladesh | Malaysia | Dubai | Indonesia | Lithuania | Georgia

🏢 Head Office (Dhaka): D/16, Zakir Hossain Road, Lalmatia, Mohammadpur, Dhaka – 1207

🏢 Office (Chittagong): 1st floor,Agrabad shopping complex, 1742 Sheikh Mujib Road, Beside Orchid Business Hotel, Chowmuhony, Agrabad, Chittagong, Bangladesh

🏢 Office (Malaysia ): TRION @ KL, JALAN DUA, CHAN SOW LIN, 55200 KUALA LUMPUR.

🏢 Office (Indonesia ): Ruko, Jl. Citra 7 Jl. Peta Barat No.16 Blok A03, RT.7/RW.11, Kalideres, West Jakarta City, Jakarta 11840