Navigating export-import documentation in Malaysia can be overwhelming, especially if you’re new to the trade game. You might find yourself buried under piles of paperwork, wondering what each document means and whether you’re missing something crucial.

The good news is, you’re not alone, and this article is here to help. Imagine the relief of knowing exactly what you need, when you need it, and how to get it right every time. This comprehensive checklist is designed to guide you through the maze of documentation with ease and confidence.

It’s tailored to give you a clear pathway, minimizing stress and maximizing efficiency in your export-import endeavors. By the end of this article, you’ll transform uncertainty into clarity, turning what once seemed like a mountain of paperwork into manageable, straightforward tasks. Whether you’re exporting palm oil or importing electronics, this checklist will be your go-to resource, ensuring you stay compliant and competitive in the dynamic world of international trade. Keep reading to unlock the secrets of seamless documentation processes in Malaysia.

Export-import Regulations

Navigating export-import regulations in Malaysia can be challenging. These rules ensure fair trade and protect the economy. Understanding them is crucial for any business involved in international trade. Knowing the right regulations helps avoid costly mistakes. It ensures smooth transactions and builds trust with global partners.

Export Licensing Requirements

Export licenses are essential documents in Malaysia. They control what goods leave the country. The government issues these licenses to track items that need monitoring. Businesses must apply for these licenses before shipping goods. Not all products require them. However, restricted items do. Familiarize yourself with the list of controlled goods. This step helps avoid legal issues and shipment delays.

Import Licensing Requirements

Like export licenses, import licenses are vital. They regulate what goods enter Malaysia. Certain products need approval before import. This ensures quality and compliance with local standards. Obtaining an import license involves submitting relevant documents. The process can take time. Start early to avoid delays in receiving goods. Check the list of restricted items regularly. This helps keep your business compliant.

Customs Declarations

Customs declarations are key in export-import processes. They provide detailed information about goods being traded. Accurate declarations prevent misunderstandings. They help avoid penalties and fines. Declare all goods correctly. Include their value, origin, and nature. This information is crucial for customs clearance. Mistakes can lead to shipment holds. Ensure all details are correct before submission.

Tariffs And Duties

Tariffs and duties affect the cost of importing and exporting. They are taxes imposed on goods crossing borders. Understanding these charges helps in pricing products correctly. Malaysia has different tariffs for various goods. Check the current rates regularly. This helps in budgeting and pricing strategies. Knowing the duties also aids in negotiating better deals with partners.

Safety And Compliance Standards

Compliance with safety standards is mandatory. It ensures the protection of consumers and the environment. Malaysia has strict regulations in place. These standards cover various product categories. Ensure your products meet these requirements. This compliance avoids legal problems and builds trust with consumers. Regularly review your products’ compliance status. Keep up with any changes in standards.

Key Authorities Involved

Navigating Malaysia’s export-import documentation involves key authorities like the Royal Malaysian Customs Department, which oversees import-export regulations. The Ministry of International Trade and Industry plays a significant role in trade policy and permits. Understanding their guidelines ensures smooth documentation processes for businesses.

Navigating export-import documentation in Malaysia can seem like a daunting task at first glance. However, knowing the key authorities involved can simplify the process significantly. These authorities play a crucial role in ensuring that your trade activities comply with Malaysian laws and regulations. Understanding their functions will not only streamline your documentation process but also enhance your confidence in managing international trade.Customs Department

The Customs Department is your first checkpoint. They are responsible for enforcing customs laws and regulations. When exporting or importing goods, you will interact with them for duties and taxes assessments. They also ensure that your goods are inspected properly before entering or leaving Malaysia.Ministry Of International Trade And Industry (miti)

MITI plays a pivotal role in shaping trade policies. They issue necessary permits and licenses for certain controlled goods. If your business deals with strategic commodities, you will need to engage with MITI to obtain the required approvals.Royal Malaysian Police

The Royal Malaysian Police might not seem like a typical authority involved in trade, but they play a significant role in security. They oversee the import and export of firearms and other restricted items. If your trade involves such goods, you must ensure compliance with their regulations.Department Of Agriculture

Agricultural products require special attention. The Department of Agriculture is responsible for ensuring that all agricultural imports and exports meet safety standards. If you are dealing with food products, you will need to navigate their inspection protocols to ensure compliance.Port Authorities

Port Authorities manage the logistics at Malaysia’s ports. They facilitate the movement of goods and oversee storage facilities. Collaborating with them ensures that your goods are handled efficiently and reach their destination on time. In your experience, have you found any authority particularly challenging to work with? Identifying potential roadblocks early can save you time and avoid costly delays. Understanding these key authorities is not just about compliance; it’s about crafting a smoother export-import journey for your business.Essential Documents Overview

Explore essential documents for export-import in Malaysia with this comprehensive checklist. Simplify trade processes and ensure compliance effortlessly. Navigate customs, shipping, and legal requirements with ease.

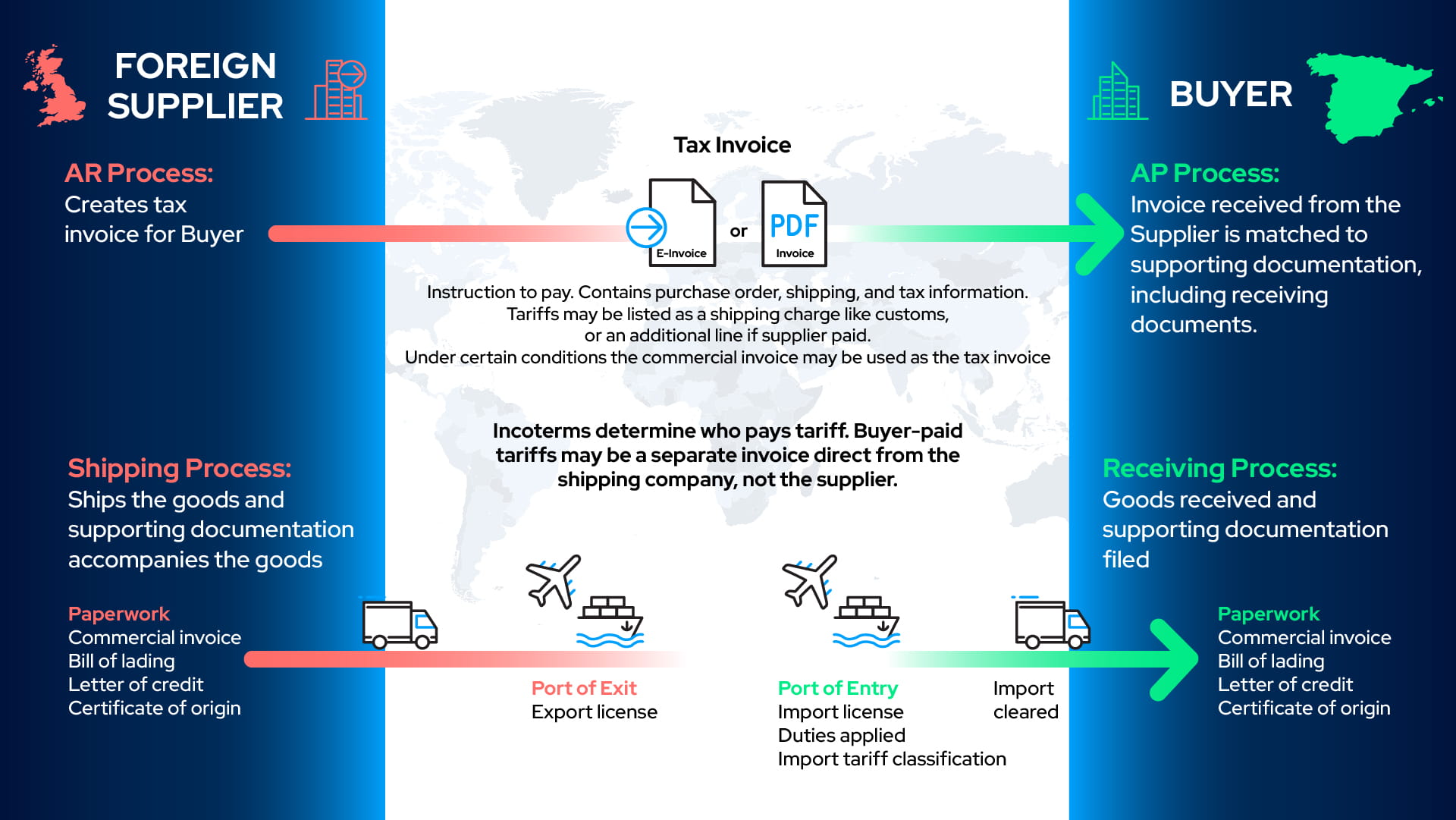

Navigating export-import documentation in Malaysia can feel like charting unknown waters. Yet, understanding the essential documents can transform this daunting task into a manageable one. Having a comprehensive checklist at your fingertips ensures that you’re well-prepared for any curveballs during international trade.Understanding The Bill Of Lading

The Bill of Lading is your shipment’s proof of ownership and receipt. It acts as a contract between the shipper and the carrier. Always check for accuracy in details such as the consignee’s name, the vessel, and the port of discharge.The Importance Of The Commercial Invoice

A commercial invoice lists the goods being sold and shipped. It is pivotal for customs clearance. Make sure it includes specific details like the buyer and seller information, a description of goods, and the total value.Role Of The Packing List

Think of the packing list as your shipment’s blueprint. It provides details about the contents, packaging method, and weight. This document is crucial for both the logistics team and customs authorities.Certificate Of Origin

This document certifies the country in which the goods were manufactured. It can impact the duties and tariffs imposed on your shipment. Ensure it is authenticated by an authorized body to avoid any hiccups.Import License Requirements

An import license might be necessary depending on the goods you are bringing into Malaysia. It’s a permit granting permission to import specific goods into the country. Check Malaysia’s specific import regulations to see if your goods require this license.Customs Declaration Form

Filing a customs declaration form is a must for clearing goods through customs. It specifies the nature of the goods, their value, and any applicable taxes. Accuracy in this document can expedite the customs process.Insurance Certificate

An insurance certificate safeguards your shipment against potential losses. It outlines the terms of the insurance coverage. Consider the risks involved in the shipment route while selecting the right insurance policy.Health And Safety Certificates

For certain products, especially food and pharmaceuticals, health and safety certificates are mandatory. These documents ensure that the goods comply with Malaysia’s health regulations. Always verify the specific requirements for your product category. Remember, while the list of documents may seem long, each serves a crucial purpose. Missing one could lead to delays or financial losses. Have you ever faced challenges with export-import documentation? Share your experiences or questions in the comments below! Your insights might just help a fellow trader.

Credit: www.instagram.com

Commercial Invoice Details

Understanding commercial invoice details is crucial for Malaysia’s export-import activities. It ensures smooth transactions and compliance with international trade laws. These details offer a clear picture of the goods being traded. This clarity helps customs officials and businesses alike.

Seller And Buyer Information

The invoice must include the seller’s and buyer’s names and addresses. This information identifies parties involved in the transaction. It also helps in case of disputes or clarifications.

Detailed Description Of Goods

Provide a comprehensive description of the goods being shipped. Include quantity, type, and specifications. This detail prevents misunderstandings about the products.

Unit Price And Total Value

Clearly state the unit price of each item. Multiply this by the quantity to get the total value. This transparency helps in calculating duties and taxes.

Currency And Payment Terms

Include the currency used for the transaction. State the payment terms agreed by both parties. This information ensures there are no financial disputes.

Shipping And Delivery Details

Clearly mention the shipping method and delivery date. This helps track the shipment’s progress. It also ensures timely delivery.

Country Of Origin

Specify the country where the goods originate. This is crucial for customs clearance. It also affects tariffs and other trade regulations.

Signature And Date

The commercial invoice should be signed and dated. This certifies the accuracy of the information provided. It also validates the document legally.

Packing List Requirements

Understanding export-import documentation in Malaysia requires a detailed checklist. Ensure all necessary documents like invoices, packing lists, and certificates are prepared. This checklist helps in smooth customs clearance.

Navigating the world of export-import documentation in Malaysia can feel like a daunting task. One critical component is the packing list, a document that outlines the contents of your shipment. This list is essential for smooth customs clearance and accurate shipping charges. Understanding its requirements will save you time and prevent costly delays.Understanding The Basics Of Packing Lists

A packing list is not just a formality. It provides a detailed description of the goods being shipped. This includes the quantity, weight, and dimensions of each item. Customs officials use this information to verify the cargo matches the accompanying documents.Essential Elements Of A Packing List

A well-prepared packing list includes several key elements. It should list the names and addresses of both the shipper and the consignee. Each item in the shipment needs a detailed description, including the number of units, type of packaging, and net and gross weight. Additionally, dimensions and volume help in calculating shipping costs.Tips For Preparing An Accurate Packing List

Accuracy is crucial when creating your packing list. Double-check all entries to ensure they match the physical shipment. Even a small error can lead to delays at customs. If you’ve ever experienced this frustration, you know it’s worth the extra effort upfront. Consider using a template to maintain consistency.Common Mistakes To Avoid

Avoid leaving out critical information like weights and dimensions. Omitting these can result in miscalculated shipping fees. Failing to list all items can cause discrepancies during inspections. It’s easy to overlook these details, especially if you’re in a hurry. Make a checklist to ensure nothing is missed.How Packing Lists Facilitate Smooth Customs Clearance

A comprehensive packing list speeds up customs clearance. With all information at hand, customs officials can process shipments more efficiently. This reduces the risk of inspections and potential fines. Think of it as providing a roadmap for your cargo’s journey.Why Packing Lists Matter For Insurance Claims

In the unfortunate event of loss or damage, the packing list becomes vital for insurance claims. It serves as proof of what was shipped and its condition. This document can make or break your claim. Ensuring its accuracy protects your investment. Creating a packing list might seem mundane, but it’s a crucial step in the export-import process. By paying attention to detail, you ensure smoother transactions and protect your business interests. Have you ever encountered issues due to a poor packing list? Share your experiences and tips in the comments.Bill Of Lading Variations

Understanding the variations of the Bill of Lading (BOL) is crucial for businesses engaged in export-import activities in Malaysia. The BOL serves as a contract and receipt for goods shipped, detailing shipment specifics. Different types exist, each with unique functions and importance. Knowing these variations helps ensure smooth logistics and compliance with Malaysian trade regulations.

Straight Bill Of Lading

The Straight Bill of Lading is non-negotiable. It names a specific consignee who must receive the goods. This type is commonly used in transactions where the seller trusts the buyer. It provides security, as only the named consignee can claim the shipment. Businesses often use it for direct relationships, reducing risks of fraudulent claims.

Order Bill Of Lading

The Order Bill of Lading is negotiable. It allows transfer of ownership by endorsement. This flexibility aids in international trade, where goods may change hands multiple times. It provides a secure payment method, as banks often require it in letters of credit. Traders can sell the cargo while it’s in transit, enhancing liquidity.

Bearer Bill Of Lading

The Bearer Bill of Lading allows the holder to claim the goods. It doesn’t specify a consignee, making it highly flexible. This type is less common due to its inherent risks. It can lead to disputes if lost or stolen. Businesses use it when goods need to be transferred without formal endorsement. Caution is advised due to potential for misuse.

Clean Bill Of Lading

The Clean Bill of Lading indicates goods were loaded without damage or defects. It’s crucial for buyers to ensure they receive goods as ordered. Any discrepancies must be noted before issuing this BOL type. It helps avoid disputes over goods’ condition. Clean BOL is often required by banks for payment processing. Ensures confidence in international shipments.

Dirty Bill Of Lading

The Dirty Bill of Lading, also known as Foul BOL, notes damage or discrepancies. It highlights issues with the shipment at loading. Essential for addressing claims, it helps resolve disputes efficiently. Businesses use it to document problems, safeguarding against unjust claims. It’s a critical tool for transparency in trade operations.

Certificate Of Origin Importance

Understanding the Certificate of Origin is crucial for smooth export-import processes in Malaysia. This document verifies the origin of goods, ensuring compliance with international trade regulations and facilitating tariff reductions. Proper documentation is key to avoiding delays and penalties in global trade transactions.

Navigating export-import documentation can be daunting, especially when you’re dealing with international trade. One critical document that often gets overlooked is the Certificate of Origin. This certificate is essentially a passport for your goods, proving where they were manufactured. Understanding its importance can save you from unnecessary headaches and smoothen the customs process.What Is A Certificate Of Origin?

A Certificate of Origin verifies the country where your goods were made. It’s not just a piece of paper; it’s a crucial element in global trade. Customs authorities use it to determine the goods’ eligibility for import tariffs or trade agreements.Why Do You Need It?

Imagine shipping your product only to have it stuck at the border. Without a Certificate of Origin, this is a real possibility. This document can influence the duty rates and help you take advantage of trade agreements Malaysia has with other countries.Ensuring Accuracy

Accuracy is vital. Mistakes can lead to delays and fines. Double-check the information, including the product description and country of origin. It’s like checking your boarding pass before a flight—you want everything correct to avoid issues.How To Obtain A Certificate Of Origin

You can get this certificate from your local Chamber of Commerce. It’s a straightforward process but requires detailed information about your goods. Think of it as filling out an application for a visa—you need to ensure all details are accurate.Impact On Your Business

A proper Certificate of Origin can speed up customs clearance. It shows that you are compliant with international trade regulations. This can enhance your business’s reputation and reliability, making customers more likely to trust you.Personal Insight: The Cost Of Ignoring

Once, I had a shipment delayed for days because the Certificate of Origin was missing. The costs incurred were significant, both financially and in terms of reputation. It was a lesson learned—the hard way—that such documentation is not optional.Actionable Tips

– Ensure Accuracy: Always verify the details before submission. – Consult Experts: If in doubt, seek advice from trade professionals. – Stay Updated: Keep abreast of changes in trade agreements and tariffs. Have you ever faced an unexpected challenge because of missing documents? Understanding the Certificate of Origin can be your first step in avoiding such pitfalls.Insurance Certificate Necessities

Navigating export-import documentation in Malaysia can seem challenging. The insurance certificate is crucial in this process. It ensures coverage against potential losses or damages. Understanding insurance certificate necessities helps smoothen trade operations. This section provides a detailed checklist.

Understanding The Insurance Certificate

The insurance certificate acts as proof of coverage. It assures both parties of protection during transit. It includes details like coverage type and insured value. Ensure the certificate is accurate and complete.

Key Elements In The Insurance Certificate

Check the certificate for key details. Include the policy number and coverage dates. Verify the insured value and goods description. Ensure all information matches your shipment documents.

Importance Of Accurate Documentation

Accurate documentation prevents misunderstandings. It protects against unexpected claims. Double-check all entries on the insurance certificate. Any errors may lead to complications.

Ensuring Compliance With Malaysian Regulations

Compliance with Malaysian regulations is vital. Make sure your insurance certificate meets all legal requirements. This avoids delays and potential fines. Consult with an expert if unsure.

Choosing The Right Insurance Provider

Select a reliable insurance provider for your needs. Consider their experience in export-import insurance. Ensure they offer support for international claims. This aids in smooth processing.

Preparing For Unexpected Events

Prepare for unexpected events during transit. Understand the claims process thoroughly. Keep all relevant documents accessible. This readiness can save time and resources.

Customs Declaration Process

Simplifying trade involves understanding Malaysia’s customs declaration process. A comprehensive checklist aids in exporting and importing goods smoothly. This process ensures compliance with regulations, avoiding delays or penalties.

Navigating the customs declaration process in Malaysia can be a daunting task, especially if you’re new to export-import documentation. This crucial step ensures that your goods are legally cleared, avoiding potential fines and delays. Understanding the customs procedures is essential to streamline your trade operations and keep your business running smoothly. Let’s dive into the key elements of the customs declaration process.Understanding The Customs Declaration Form

The first step is to familiarize yourself with the customs declaration form. It’s a mandatory document that provides detailed information about your shipment. Make sure you fill out this form accurately to avoid complications. Any errors here can lead to unnecessary scrutiny and delays.Required Documentation For Customs Clearance

Gather all necessary documents before submission. Common requirements include the commercial invoice, packing list, bill of lading, and certificate of origin. Double-check each document for accuracy and completeness. Missing or incorrect documents can halt your shipment at the border.Classifying Your Goods

Properly classifying your goods is crucial. Use the Harmonized System (HS) codes to categorize your items. Accurate classification ensures you’re paying the correct duties and taxes. Misclassification can result in heavy penalties.Paying Duties And Taxes

Once your goods are classified, calculate the duties and taxes owed. Payment is typically required before customs release your goods. Consider allocating a budget for these costs to avoid unexpected financial strain.Submitting Your Declaration

Submit your customs declaration via the Malaysian customs electronic system. This online platform streamlines the process and speeds up clearance. Make sure to track the status of your submission to address any issues promptly.Engaging A Customs Broker

If the process feels overwhelming, consider hiring a customs broker. They specialize in navigating the complexities of customs procedures. While it incurs a cost, their expertise can save you time and headaches. Navigating the customs declaration process isn’t just about ticking boxes. It’s about understanding each step and ensuring compliance. How do you handle your customs documentation? Are there areas you can improve to make the process smoother? Share your thoughts and experiences in the comments.Import License Procedures

Navigating Malaysia’s export-import documentation involves understanding key steps for obtaining an import license. Prepare required documents, submit applications, and adhere to regulations. These steps ensure smooth trade operations and compliance with Malaysian authorities.

Navigating the import license procedures in Malaysia can seem daunting. Yet, understanding the steps can simplify the process. Malaysia requires import licenses for various goods to ensure compliance with regulations. Knowing how to acquire these licenses is crucial for businesses.What Is An Import License?

An import license is a government document. It allows businesses to bring goods into Malaysia. Different products may require different types of licenses. Ensure your goods meet the necessary criteria before applying.Identifying The Relevant Authority

The type of product determines the relevant authority. Each authority has specific guidelines for issuing licenses. Contact the right authority for accurate information. This saves time and prevents application errors.Preparing Necessary Documentation

Gather all required documents before applying. Common documents include a company registration certificate. Also, prepare invoices, packing lists, and product descriptions. Double-check all documents for accuracy.Submitting The Application

Submit your application through the relevant authority’s online portal. Follow instructions carefully. Mistakes can delay the process. Keep a copy of your submission for reference.Awaiting Approval

Approval times can vary based on the product and authority. Stay updated by checking the status regularly. Contact the authority if delays occur. A proactive approach helps avoid unnecessary hold-ups.Export Permit Guidelines

Navigating export-import documentation in Malaysia requires understanding export permit guidelines. A comprehensive checklist ensures smooth processing. Clear instructions help avoid delays and ensure compliance.

Navigating export-import documentation in Malaysia can feel like untangling a complex web of requirements. However, understanding the Export Permit Guidelines can simplify the process significantly. Whether you’re a seasoned exporter or new to international trade, having a clear checklist can make a world of difference in ensuring smooth transactions. ###Understanding The Need For An Export Permit

Securing an export permit is crucial for specific goods leaving Malaysia. It ensures compliance with international trade laws and protects national interests. Missing this step can result in delays or fines, impacting your business operations. ###Identifying Goods Requiring Export Permits

Not all goods need an export permit. Items like timber, rubber, and certain electronics do. Always check Malaysia’s Export Control List to see if your product is included. This proactive step saves time and helps you avoid unnecessary complications. ###Steps To Obtain An Export Permit

Applying for an export permit involves a few straightforward steps: 1. Register with the Malaysian Ministry of International Trade and Industry (MITI). 2. Submit your application through the appropriate online platform. 3. Provide necessary documentation, such as product details and destination country. These steps help streamline the process and ensure you have everything in place. ###Common Challenges And How To Overcome Them

One challenge is incomplete documentation. Double-check all paperwork before submission. Engaging with a local consultant familiar with Malaysia’s export regulations can also be beneficial. They offer insights and practical tips to avoid common pitfalls. ###Importance Of Staying Updated

Export regulations can change. Keeping abreast of updates ensures ongoing compliance. Subscribe to trade newsletters or join relevant industry groups. This proactive approach keeps you informed and ready to adapt. ###Personal Experience: The Impact Of Being Prepared

I once overlooked the export permit for a shipment of electronics. The delay cost us a major client. It was a costly lesson in ensuring all documentation is in order. Taking the time to prepare thoroughly can prevent such setbacks and foster long-term success. Engaging in international trade offers immense opportunities. Yet, as you navigate the export-import landscape in Malaysia, diligence in following the Export Permit Guidelines can set the foundation for successful global ventures. Are you ready to take the next step in your export journey?Health And Safety Certifications

Understanding health and safety certifications is crucial for export-import documentation in Malaysia. This checklist helps ensure compliance and smooth operations. It simplifies the process for businesses dealing with international trade.

Navigating the maze of export-import documentation in Malaysia requires careful attention. Health and safety certifications play a crucial role in ensuring compliance. These certifications are essential for safeguarding public health and ensuring safe products. Importers and exporters must understand the requirements to facilitate smooth trade processes. This section provides a comprehensive checklist for navigating health and safety certifications in Malaysia.Understanding Health And Safety Certifications

Health and safety certifications are mandatory for many products. These include food, pharmaceuticals, and electronics. Products must meet Malaysian safety standards to enter the market. Failing to comply can lead to legal consequences. Certifications assure consumers that products are safe and reliable.Types Of Health And Safety Certifications

Various certifications exist for different product categories. For food items, the Ministry of Health issues certifications. Pharmaceuticals need approval from the National Pharmaceutical Regulatory Agency. Electronics require compliance with the Malaysian Communications and Multimedia Commission. Each certification serves a unique purpose.Steps To Obtain Certifications

First, identify the relevant certification body. Submit the necessary documents for evaluation. These may include test reports and product specifications. The authorities will review submissions for compliance. Upon approval, the certification is issued. This process ensures products meet safety standards.Common Challenges And Solutions

Navigating certifications can present challenges. Language barriers often hinder understanding. Hiring a local consultant can ease the process. They provide expertise and facilitate communication. Delays in document processing may occur. Early submission helps mitigate this risk.Importance Of Compliance

Compliance is essential for successful trade. It builds trust with consumers and partners. Non-compliance can result in fines or product recalls. Adhering to certification requirements protects business reputation. It also enhances market access and competitiveness.Product Standards Compliance

Exporting and importing in Malaysia requires understanding product standards compliance. Prepare essential documents to meet regulatory demands efficiently. This checklist ensures smooth transactions and adherence to necessary guidelines.

Navigating the maze of export-import documentation in Malaysia can be daunting, especially when it comes to ensuring your products meet the necessary standards. Product standards compliance is crucial for smooth trade operations and avoiding costly delays or penalties. Understanding the requirements and processes involved can significantly enhance your efficiency and confidence in handling international trade.Understanding Product Standards In Malaysia

Product standards in Malaysia are designed to ensure safety, quality, and environmental sustainability. Whether you’re dealing with electronics, food, or textiles, each category has specific standards you must adhere to. Familiarize yourself with these standards by consulting resources like the Malaysian Standards Department or industry-specific associations.Identifying Relevant Standards For Your Products

Every product has unique compliance needs. Start by identifying the standards relevant to your product category. For instance, if you are exporting electronics, look into the Malaysian Electrical and Electronics Standards. Recognizing the right standards early can save you time and prevent errors.Documentation Required For Compliance

Once you’ve identified the necessary standards, gather the required documentation. This often includes certificates of compliance, testing reports, and quality assurance documents. Double-check each document for accuracy and completeness. Missing paperwork can halt your export process.Working With Certification Bodies

Certification bodies play a pivotal role in validating your product’s compliance. Engage with recognized bodies to obtain the required certifications. Share your experiences with these organizations to build trust and streamline future processes. Having a reliable partner can ease your compliance journey.Staying Updated With Changes

Regulations and standards evolve over time. Stay informed about any changes that may impact your product compliance. Subscribe to industry newsletters or join trade associations. Being proactive in monitoring updates can help you adapt quickly and avoid compliance issues.Personal Experience: Learning From Mistakes

I once had a shipment delayed due to a missing compliance certificate. The experience taught me the importance of meticulous documentation. Now, I triple-check every detail and maintain a checklist to ensure nothing is overlooked. This habit has since saved me from potential setbacks.Takeaway: Prioritize Compliance For Seamless Trade

Product standards compliance isn’t just a bureaucratic hurdle; it’s a gateway to international markets. Ensuring compliance means you are safeguarding your business’s reputation and paving the way for seamless trade operations. Are you confident in your compliance strategy? Consider revisiting your checklist today. By understanding and prioritizing product standards compliance, you can navigate Malaysia’s export-import documentation with greater ease and success.

Credit: seoagencychina.com

Tax And Duty Documentation

Navigating export-import documentation in Malaysia involves understanding tax and duty requirements. A comprehensive checklist ensures compliance. Proper documentation streamlines the process, reducing delays.

Navigating the maze of export-import documentation can be daunting, but understanding tax and duty documentation is crucial for smooth operations in Malaysia. This paperwork ensures compliance with Malaysian customs and helps avoid unexpected costs. Thorough knowledge of tax and duty can streamline your business and enhance profitability.Understanding Tax Codes

Tax codes are essential for classifying goods and determining duty rates. Do you know the right tax code for your product? If not, it’s time to find out. Identifying the correct code prevents misclassification and hefty penalties.Customs Duty Rates

Duty rates vary based on product categories. Are you aware of the rates applicable to your goods? By knowing the rates, you can accurately calculate the total cost involved in importing or exporting. This knowledge aids in setting competitive prices.Tax Exemptions And Reductions

Did you know certain goods are exempt from taxes or eligible for reductions? Discover if your products qualify for these benefits. Leveraging exemptions can lead to significant cost savings and enhance your market position.Proper Documentation

Accurate documentation is key to smooth customs clearance. Have you double-checked the paperwork for errors? Mistakes can lead to delays and additional costs. Ensure all documents are precise and complete.Engaging A Tax Consultant

Consider hiring a tax consultant to navigate complex regulations. Have you thought about professional assistance? Consultants can offer valuable insights and help you stay compliant, saving you time and stress. Navigating tax and duty documentation can be challenging, but it’s worth the effort. By understanding these aspects, you pave the way for seamless transactions and sustainable growth in the Malaysian market. Are you ready to optimize your export-import process?Trade Agreements Impact

Understanding trade agreements is crucial for handling export-import documentation in Malaysia. These agreements simplify processes, reduce tariffs, and ensure smoother international trade. Keep a comprehensive checklist to navigate the necessary paperwork efficiently.

Navigating the complex world of export-import documentation in Malaysia requires a keen understanding of how trade agreements impact your business. Trade agreements can simplify or complicate your documentation process, affecting everything from tariffs to shipping procedures. Understanding these agreements is crucial for smooth operations and maximizing your competitive edge in the international market.Understanding Trade Agreements

Trade agreements are formal arrangements between countries that determine the rules for cross-border trade. They can affect tariffs, quotas, and even the quality standards your products must meet. Malaysia is part of several trade agreements, each with its own set of rules. Are you aware of the specific agreements that impact your industry? Understanding these can be the difference between paying hefty tariffs and enjoying duty-free trade.The Role Of Asean In Trade

Malaysia is a member of the Association of Southeast Asian Nations (ASEAN), which plays a significant role in shaping trade policies. ASEAN trade agreements often provide reduced tariffs and simplified documentation for member countries. If you’re exporting within ASEAN countries, you might benefit from these agreements. Have you checked if your goods qualify for preferential treatment under these agreements?Leveraging Free Trade Agreements (ftas)

Malaysia has entered into multiple FTAs that offer businesses the chance to trade with reduced tariffs and less paperwork. These agreements can be bilateral or multilateral, each with unique benefits. Ensuring your documentation aligns with the requirements of these FTAs can save time and money. Have you explored how specific FTAs can benefit your export-import operations?Practical Steps To Comply With Trade Agreements

Understanding which trade agreements apply to your business is just the start. You need to ensure compliance by aligning your documentation with the terms of these agreements. This could involve using specific forms or codes that validate your eligibility for reduced tariffs. Do your current processes ensure compliance with these agreements, or is there room for improvement?Common Challenges And Solutions

One common challenge is staying updated on changes in trade agreements. These can change with little notice, impacting your operations. Regularly consulting with trade experts or using digital tools for updates can mitigate these challenges. Are you proactive in keeping abreast of such changes, or do you find yourself scrambling to adapt? Navigating the intricacies of trade agreements can seem daunting, but understanding their impact is essential for successful export-import operations in Malaysia. By familiarizing yourself with these agreements, you can simplify your documentation process and gain a competitive advantage. Are you ready to optimize your trade strategy today?Digital Documentation Tools

Navigating export-import documentation in Malaysia requires thorough preparation. Digital documentation tools streamline processes, ensuring compliance with regulations and efficient record management. A comprehensive checklist helps businesses manage paperwork, reducing errors and delays in international trade.

Navigating the labyrinth of export-import documentation in Malaysia can be daunting. However, digital documentation tools are transforming this tedious task into a streamlined process. Imagine reducing hours of paperwork to mere minutes with just a few clicks. These tools not only enhance efficiency but also minimize errors, ensuring that your shipments move smoothly across borders. Whether you’re a seasoned trader or new to the scene, embracing digital tools can significantly simplify your experience.Understanding Digital Documentation Tools

Digital documentation tools refer to software and platforms that help you manage, organize, and submit export-import documents electronically. They offer features like document templates, electronic signatures, and cloud storage. This makes it easy to access your files anytime, anywhere. Using these tools can help you avoid the hassle of keeping track of physical papers. They also reduce the risk of losing important documents during transit. With everything stored digitally, you can focus on growing your business instead of worrying about paperwork.Benefits Of Going Digital

Digital tools bring numerous benefits to your export-import operations. They save time by automating repetitive tasks, allowing you to allocate resources to more critical areas. Additionally, they help you maintain compliance with Malaysia’s trade regulations by providing up-to-date templates and guidelines. These tools also enhance collaboration. By sharing documents online, your team can work together seamlessly, regardless of their location. Have you ever thought about how much more efficient your processes could be with everyone on the same page?Choosing The Right Tool For Your Business

Selecting the right digital documentation tool can be a game-changer. Consider factors like user-friendliness, cost, and customer support. Choose a tool that integrates well with your existing systems to ensure a smooth transition. Look for features that match your business needs. For example, if your company deals with large shipments, opt for tools that offer robust tracking and reporting features. Remember, the right tool should simplify your workflow, not complicate it.Real-life Application And Success Stories

Many businesses in Malaysia have successfully transitioned to digital documentation. Take, for instance, a small logistics firm that managed to cut its processing time by half. By adopting a digital tool, they reduced errors and improved customer satisfaction. Consider asking yourself: Could digital tools be the key to unlocking new efficiency levels in your business? Embrace the digital revolution in export-import documentation and witness the transformation in your workflow. If you’ve tried digital documentation tools, what has your experience been? Share your thoughts in the comments!Record Keeping Strategies

Effective record keeping is crucial in the export-import business. In Malaysia, maintaining accurate records ensures compliance with regulations. It also streamlines operations and aids in decision-making. Let’s delve into strategies that can enhance your record-keeping practices.

1.Understand Local RegulationsFamiliarize yourself with Malaysia’s specific documentation requirements. This includes customs declarations, invoices, and permits. Knowing these helps in maintaining accurate records.

2.Organize Digital ArchivesUtilize digital tools for storing and accessing documents. This reduces paper clutter and ensures easy retrieval. Choose reliable software for efficient document management.

3.Implement Consistent Naming ConventionsUse clear and consistent naming for files. This aids in quick identification and reduces errors. Develop a system that every team member understands.

4.Regularly Update RecordsKeep your records up-to-date. Regular updates prevent data discrepancies. Schedule routine checks to ensure accuracy.

5.Ensure Data SecurityProtect sensitive information from unauthorized access. Use passwords and encryption to safeguard data. Regularly back up your records to prevent data loss.

6.Train Your TeamEducate your team on effective record-keeping practices. Training ensures everyone adheres to the same standards. It also improves efficiency and reduces errors.

7.Review and Audit RegularlyConduct regular audits of your records. This identifies gaps and areas for improvement. Continuous reviews maintain the integrity of your documentation.

8.Utilize Cloud Storage SolutionsCloud storage offers flexibility and accessibility. It allows access to records from anywhere, anytime. Choose a secure provider to ensure data protection.

9.Track Document VersionsKeep track of different versions of documents. This helps in monitoring changes and updates. Use version control tools for efficient tracking.

10.Maintain a Centralized DatabaseA centralized database ensures all records are in one place. This enhances data management and retrieval. It also reduces redundancy and confusion.

Credit: www.instagram.com

Common Documentation Errors

Navigating Malaysia’s export-import documentation involves common errors like missing details and incomplete forms. Avoid delays by double-checking entries. Ensure all documents meet requirements for smooth transactions.

Navigating through export-import documentation in Malaysia can be daunting. You may find yourself tangled in paperwork that seems to never end. One common challenge that many face is dealing with errors in documentation. These mistakes can lead to delays, extra costs, and even legal issues. Understanding these common errors and how to avoid them is crucial for a smooth transaction process. Are you ready to learn about these pitfalls and how you can steer clear of them?Incorrect Information

Providing wrong information is a frequent mistake. This could be anything from incorrect product descriptions to errors in quantities or values. Even small discrepancies can cause big problems. Double-check your entries before submission. It might be helpful to have someone else review your documents. A fresh pair of eyes can catch mistakes you might overlook.Missing Signatures

Have you ever rushed through paperwork only to realize you missed a signature? Missing signatures can halt your export-import process. Make sure all required parties have signed the documents. Create a checklist to ensure nothing is missed. It’s a simple step that saves you from unnecessary headaches.Inadequate Supporting Documents

Sometimes, you might think you’ve got everything covered, only to find out you missed essential supporting documents. This can include certificates, licenses, or approvals needed for specific goods. Ensure you have a comprehensive list of required documents for each transaction. Check with the relevant authorities if you’re unsure about what’s needed.Misinterpretation Of Requirements

The regulations can be complex and vary depending on the type of goods. Misinterpreting these requirements is another common error. Spend time understanding what each form requires. You might find it beneficial to attend workshops or seminars on export-import documentation. These can provide valuable insights and updates on regulations.Lack Of Consistency

Consistency across all documents is crucial. Inconsistent information can lead to confusion and delays. Maintain uniformity in details such as product names, addresses, and identification numbers. Consider using templates or standardized formats to avoid discrepancies. Have you experienced any of these errors before? How did you handle them? Share your thoughts and tips in the comments below. Your insights could be the key to helping others avoid similar pitfalls.Training And Resources

Understanding export-import documentation in Malaysia requires proper training and access to resources. Businesses must equip themselves with knowledge to ensure smooth operations. Comprehensive training and reliable resources can simplify complex procedures.

Training Programs For Export-import Documentation

Various institutions offer training programs on export-import documentation. These programs cover essential topics like customs procedures and documentation requirements. They provide practical insights into handling paperwork efficiently. Attendees gain valuable skills applicable to real-world scenarios.

Online Courses And Webinars

Online courses and webinars are convenient options for learning. They offer flexibility and cover a wide range of topics. Participants can learn at their own pace and revisit materials. Many courses include interactive sessions with experts.

Government Resources

The Malaysian government offers resources for exporters and importers. Official websites provide guidelines and updates on regulations. Access to these resources ensures compliance with legal requirements. Businesses can find detailed information on documentation processes.

Industry Associations And Networking

Industry associations are valuable for networking and learning. They organize events and provide resources on best practices. Members can share experiences and solutions to common challenges. These associations are crucial for staying informed.

Future Trends In Documentation

Exploring export-import documentation in Malaysia requires understanding complex regulations and procedures. A comprehensive checklist simplifies this process. Staying informed about future trends ensures efficient navigation through these essential documents.

Navigating the complexities of export-import documentation in Malaysia is no small feat. As global trade evolves, documentation processes are also changing. Future trends in documentation are leaning towards efficiency and digital transformation. Understanding these trends can give you a competitive edge in the market. What changes should you be aware of, and how can you prepare for them? Let’s explore.1. Embracing Digital Transformation

Digitalization is rapidly altering the landscape of trade documentation. Many countries, including Malaysia, are moving towards electronic documentation to streamline processes. This shift reduces paperwork, speeds up transactions, and enhances accuracy. Are you ready to embrace digital solutions for your export-import needs?2. Blockchain Technology In Trade

Blockchain is not just for cryptocurrencies; it’s making waves in trade documentation too. It offers a secure, transparent way to manage documents. With blockchain, you can track your documents in real-time, reducing the risk of fraud. Imagine having all your trade documents securely stored and easily accessible. Wouldn’t that simplify your operations?3. The Role Of Artificial Intelligence

AI is stepping into the world of trade documentation, offering tools for automation and predictive analytics. This technology can help you forecast market trends and optimize your documentation processes. AI-driven systems can also alert you to potential compliance issues before they become problems. How might AI change the way you handle export-import documentation?4. Increased Focus On Sustainability

Sustainability is becoming a key factor in global trade. Documentation processes are reflecting this trend with the adoption of eco-friendly practices. This includes reducing paper usage and ensuring compliance with environmental regulations. By going green, you not only help the planet but also align with global standards. Are your documentation processes sustainable?5. Enhanced Data Security Measures

With increased digitalization comes the need for robust data security. Protecting sensitive trade information is crucial. Future trends in documentation emphasize the importance of cybersecurity measures. Ensuring your data is secure can prevent costly breaches and maintain trust with your partners. How secure is your current documentation system? Staying ahead in the export-import business means adapting to these emerging trends. As you navigate the evolving landscape of trade documentation in Malaysia, ask yourself: Are you prepared for the future?Frequently Asked Questions

What Documents Are Needed For Export In Malaysia?

To export goods from Malaysia, key documents are required. These include the commercial invoice, packing list, bill of lading, and export permit. Additionally, a certificate of origin and insurance certificate may be needed. Ensure all documents are accurately completed to facilitate smooth customs clearance.

How To Obtain An Import License In Malaysia?

To obtain an import license in Malaysia, first identify the specific products that require licensing. Then, apply through the Malaysian Ministry of International Trade and Industry (MITI) or relevant authorities. Ensure you provide necessary documentation, including business registration and product details, to expedite the process.

Why Is A Certificate Of Origin Important?

A certificate of origin is crucial for verifying the product’s country of manufacture. It determines eligibility for preferential tariffs under trade agreements. This document helps customs authorities assess duties and taxes accurately, ensuring compliance with international trade regulations and facilitating smoother import-export processes.

How To Ensure Accuracy In Export-import Documentation?

Ensuring accuracy in export-import documentation involves meticulous attention to detail. Double-check all information, including product descriptions, quantities, and values. Use reliable templates and consult with experts when necessary. Regular audits and training can help maintain accuracy, reducing the risk of delays or penalties.

Conclusion

Understanding export-import documentation in Malaysia is crucial for smooth trade. The checklist provided helps ensure no detail is overlooked. Staying organized saves time and prevents errors. It also boosts confidence in handling international transactions. Always double-check documents to avoid costly mistakes.

Remember, accurate paperwork is key to successful trading. Familiarize yourself with regulations and stay updated. This approach will facilitate seamless business operations. Trade confidently with the right documentation in hand. Embrace these practices for a hassle-free import-export experience. Your business will thank you for it.

Keep this guide handy for future reference.