Imagine losing your peace of mind over an unforeseen car accident or theft that affects your rental business. As a car rental business owner in Malaysia, you know how vital it is to safeguard your vehicles and your investment.

The right insurance can be your safety net, ensuring you’re protected against unexpected financial losses. But how do you choose the best insurance policy? What should you look for to make sure you’re fully covered? This article will guide you through the intricacies of insurance for your car rental business in Malaysia, helping you make informed decisions that can save you money and stress.

Dive in to uncover the essentials that could shield your business from risks and allow it to flourish.

Essentials Of Car Rental Insurance

Understanding car rental insurance is vital for your business in Malaysia. It covers potential damages and liabilities. Ensure protection and peace of mind for both your company and customers.

Understanding insurance for your car rental business in Malaysia can feel overwhelming. Yet, grasping the essentials of car rental insurance is not just crucial—it’s empowering. This knowledge helps you protect your assets, your business, and your clients. So, what are the essentials you need to know to make informed decisions?What Is Car Rental Insurance?

Car rental insurance is coverage that protects your vehicles and your business. It safeguards against financial losses from accidents, theft, or damages. Think about it: how would an unexpected incident impact your business? Having the right insurance can be the difference between a minor setback and a major financial hurdle.Why Is It Important?

Insurance is not just a legal requirement; it’s a smart business move. It ensures that your business can continue operating smoothly even when things go wrong. Imagine a customer getting into an accident with one of your cars—without insurance, you could face hefty repair bills. With the right coverage, those costs are manageable.Types Of Coverage Available

Understanding the types of coverage available is key. Comprehensive insurance covers damages to your vehicles from non-collision events like theft or natural disasters. Third-party liability covers damages to other people or property. Then there’s collision damage waiver which covers the rental car in the event of an accident. Have you considered which of these best suits your business needs?Common Exclusions To Watch Out For

Not all events are covered by car rental insurance. Common exclusions include driving under the influence, unauthorized drivers, and off-road use. Knowing these can save you from unexpected surprises. Have you checked your policy for such exclusions?Customizing Your Insurance Plan

Tailoring your insurance plan to fit your business is crucial. A one-size-fits-all policy might not cover specific risks unique to your operations. Work with your insurer to craft a plan that fits like a glove. Have you thought about what customizations might benefit your business? Understanding these essentials can transform how you approach insurance for your car rental business. It’s about making informed choices that protect and grow your business. What steps will you take today to ensure your business is adequately covered?Types Of Coverage

Car rental businesses in Malaysia need various insurance coverage types. Liability insurance covers damages to third parties. Collision and comprehensive insurance protect against car damage, theft, or vandalism. Personal accident insurance ensures medical expenses are covered. Each type safeguards different aspects of the rental service.

Understanding the various types of insurance coverage for your car rental business in Malaysia is crucial. This knowledge can save you from unexpected financial hits and ensure smooth operations. Whether you’re just starting out or looking to optimize your existing policy, understanding these coverages can help you make informed decisions. ###Third-party Liability Coverage

Third-party liability coverage is a legal requirement in Malaysia. It covers damages or injuries caused to others by your rental vehicles. Without this, you could be personally liable for substantial costs. Imagine a client getting into an accident and you’re saddled with the repair bills and medical expenses. This coverage ensures you’re protected from such unexpected situations. ###Comprehensive Coverage

Comprehensive coverage offers a wider safety net. It not only covers third-party liabilities but also damages to your own vehicles. Think about it as a safeguard against theft, vandalism, or natural disasters. You wouldn’t want to be out of pocket if a sudden storm damages your fleet. Many rental business owners find this peace of mind worth the investment. ###Personal Accident Coverage

Personal accident coverage is an optional but wise choice. It provides compensation for injuries to the driver and passengers in your rental vehicles. Picture this: a client gets into an accident and suffers injuries. This coverage can help with their medical costs, potentially saving you from negative customer experiences and financial strain. ###Loss Of Use Coverage

Loss of use coverage is often overlooked but highly beneficial. It compensates you for potential income loss when a vehicle is off the road due to repairs. You can’t rent out a damaged car, but the bills still pile up. This coverage ensures your business income doesn’t come to a halt due to unforeseen events. ###Additional Coverage Options

There are also additional coverage options you might consider. These can include windscreen protection or flood coverage, depending on the specific risks in your area. Are you prepared for a sudden flood damaging your vehicles? Assess your local risks and tailor your insurance policy to fit your unique needs. Understanding these types of coverage can make a significant difference in the financial health of your car rental business. Which coverage do you think would be most beneficial for your fleet? Consider your specific circumstances and ensure your business is adequately protected.Liability Insurance Explained

Understanding liability insurance is crucial for any car rental business owner in Malaysia. You might think of it as a safety net that protects your business from unforeseen mishaps. But what exactly does it cover, and why is it essential? Let’s break it down.

What Is Liability Insurance?

Liability insurance is designed to protect your business from claims stemming from injuries or damages. Imagine a scenario where a customer has an accident in one of your rental cars. Without liability insurance, you could be responsible for hefty legal fees and compensation.

Now, you might wonder how it impacts your business. Simply put, it shields you from financial losses that could otherwise cripple your operations.

Coverage Details

Liability insurance typically covers bodily injuries and property damage. If a renter injures someone while driving one of your cars, the insurance can cover medical expenses. It also helps if your vehicle damages another car or property.

Have you ever considered what happens if a renter decides to sue? Liability insurance steps in here too, covering legal costs and settlements.

Why You Need It

Running a car rental business without liability insurance is like driving blindfolded. Accidents are unpredictable, and the financial risks are high. Picture the peace of mind knowing you’re covered if something goes wrong.

Would you rather focus on growing your business than worrying about unforeseen mishaps? Liability insurance allows you to do just that, providing a safety net for your investments.

Choosing The Right Coverage

Not all liability insurance policies are the same. It’s essential to choose one that suits your business needs. Consider the size of your fleet, typical rental durations, and your customer base.

Have you assessed the types of vehicles you rent? More expensive cars might require higher coverage limits. Tailor your policy to match your specific situation, ensuring optimal protection.

Key Takeaways

Liability insurance is not just a legal requirement; it’s an essential part of safeguarding your car rental business. It protects you from financial losses and allows you to focus on growth.

Take a moment to review your current policy. Are you adequately covered? If not, it might be time to reconsider your options and secure your business’s future.

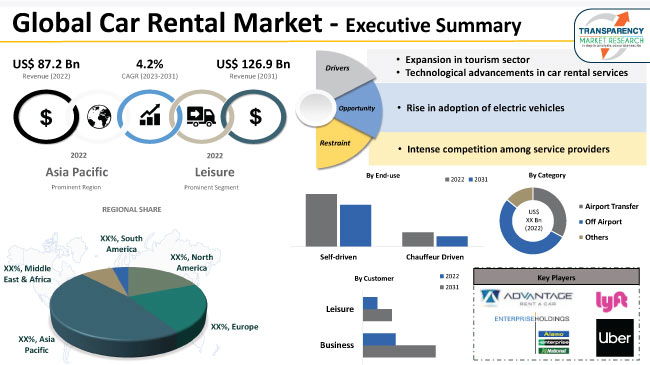

Credit: www.transparencymarketresearch.com

Collision Damage Waiver

Understanding insurance options is crucial for car rental businesses in Malaysia. One of the key components is the Collision Damage Waiver (CDW). This waiver can save your business from hefty repair costs. It offers financial protection if a rented vehicle is damaged. CDW often reduces the renter’s financial responsibility. It is vital for any car rental operation.

What Is A Collision Damage Waiver?

A Collision Damage Waiver is not insurance. It is an optional add-on. CDW covers damage to the rental vehicle. Renters pay a daily fee for this coverage. It limits or waives their liability in case of an accident. This can be a great relief for both renters and businesses.

Benefits Of Offering Cdw

Offering CDW can attract more customers. Many prefer the peace of mind it provides. It also protects your fleet. Damage repairs can be costly. CDW helps manage these expenses. This can improve your business’s financial stability.

How Cdw Differs From Traditional Insurance

Traditional insurance covers a broader scope. CDW focuses on collision-related damages only. It does not cover theft or personal injuries. Understanding this distinction is important. It helps set the right expectations for your customers.

Cdw Cost Considerations

The cost of CDW varies. Factors include vehicle type and rental duration. Setting competitive pricing is key. It ensures you remain attractive to customers. At the same time, it covers potential repair costs efficiently.

CDW is not legally required in Malaysia. But, it is highly recommended. It offers significant protection for your business. Understanding local regulations is crucial. This ensures compliance and protects your interests.

Personal Accident Insurance

Understanding insurance for your car rental business in Malaysia is crucial. Among the types of coverage, Personal Accident Insurance stands out. It provides financial protection in case of accidents involving your clients. This insurance type ensures peace of mind for renters during their travels. Let’s delve into its details and importance for your business.

What Is Personal Accident Insurance?

Personal Accident Insurance covers medical expenses from accidents. It applies to passengers and drivers. This insurance offers a safety net. It helps with hospital bills and other expenses. Renters feel secure knowing they have this protection.

Benefits Of Personal Accident Insurance

This insurance reduces financial stress after an accident. It covers a wide range of injuries. Renters are protected from unexpected costs. The coverage can include ambulance fees. It offers compensation for long-term injuries.

Why Your Business Needs It

Offering this insurance attracts more customers. People prefer renting from businesses that provide extra safety. It increases customer trust and satisfaction. Your business reputation improves with comprehensive coverage. Customers feel valued and secure.

How To Implement Personal Accident Insurance

Choose an insurance provider with a good track record. Discuss coverage options and fees. Ensure the insurance policy is easy to understand. Provide clear information to your clients. Make insurance an integral part of your rental agreement.

Theft Protection Coverage

Protecting your car rental business in Malaysia involves understanding theft protection coverage. This insurance helps cover losses from vehicle theft, reducing financial risks. Ensure your policy includes comprehensive theft protection to safeguard your assets efficiently.

Understanding insurance for your car rental business in Malaysia is crucial for safeguarding your investment. Theft protection coverage is one of the essential aspects you must consider. This coverage can help you manage the financial risks associated with vehicle theft, ensuring your business remains resilient even in challenging situations. ###What Is Theft Protection Coverage?

Theft protection coverage is an insurance policy that covers the loss of your rental vehicles due to theft. It ensures you don’t have to bear the entire financial burden if a vehicle is stolen while rented out. This coverage typically includes compensation for the market value of the car at the time of theft. It also often covers the cost of replacing locks and keys if needed. ###Why Is Theft Protection Important For Your Business?

Car theft can be a significant financial hit for any rental business. Without adequate coverage, you might find yourself struggling to replace stolen vehicles, impacting your operations and bottom line. Additionally, theft protection can enhance your credibility with clients. When you offer comprehensive insurance, customers feel more secure renting from you, knowing they are not solely liable for theft. ###How Does Theft Protection Work In Malaysia?

In Malaysia, theft protection is often bundled with other types of car rental insurance. It usually comes with terms and conditions detailing what is covered and any exclusions. Understanding these terms is crucial. For instance, some policies might not cover theft if the vehicle was left unlocked or unattended with the keys inside. ###Factors To Consider When Choosing Theft Protection

When selecting theft protection, consider the premium costs versus the coverage offered. Does the policy cover the full market value of your vehicles? Are there any excess fees? It’s also important to check if there are specific requirements for making a claim. Some insurers might require a police report within a certain time frame or proof of security measures in place. ###Personal Insight: Learning From Experience

Once, I rented out a car to a client who left it in a secluded area overnight, and it got stolen. Thankfully, having theft protection coverage saved my business from a major loss. This experience taught me the importance of thoroughly explaining insurance terms to customers. It also highlighted the need for clear policies regarding where and how vehicles should be parked. ###Ensuring Comprehensive Protection

Theft protection should be part of a broader insurance strategy. Pair it with liability and collision coverage to fully protect your rental fleet. Evaluate different insurance providers to find one that offers the best combination of coverage and cost. Regularly reviewing your policy ensures it meets your evolving business needs. Are you prepared if one of your vehicles goes missing? With the right theft protection, you can face such challenges confidently.Third-party Liability

Understanding insurance is crucial for any car rental business in Malaysia. One key component is Third-Party Liability. This type of insurance protects against claims from third parties. It covers damages caused by your rental vehicles to other people or property. Without it, your business faces significant risks and financial burdens.

What Is Third-party Liability?

Third-Party Liability is a legal requirement in Malaysia. It ensures compensation for damage or injury caused by your rental cars. This coverage does not include damage to your own vehicles. It solely protects against claims from others.

Why Third-party Liability Matters

Accidents can happen anytime. Even with careful planning. Third-Party Liability shields your business from costly legal fees. It also helps maintain trust with customers. They know you are prepared for unforeseen events.

How To Choose The Right Policy

Choosing the right policy requires careful consideration. Evaluate the coverage limits. Ensure they meet your business needs. Check the insurer’s reputation. A reliable provider offers peace of mind. Compare different plans. Look for the best balance of cost and coverage.

Benefits Of Third-party Liability

This insurance offers several benefits. It minimizes financial risks. Protects your business from potential lawsuits. Provides assurance to customers. They feel more secure renting from you. It also demonstrates responsibility. A well-insured business attracts more clients.

Common Misconceptions

Many misunderstand Third-Party Liability. Some think it covers their own vehicle damages. This is incorrect. It only covers damages to others. Understanding this distinction is vital. It ensures proper coverage and avoids gaps in protection.

Credit: www.twicecommerce.com

Choosing The Right Insurer

Choosing the right insurer for your car rental business in Malaysia is crucial. The insurance landscape can be complex, but selecting a suitable partner ensures protection and peace of mind. It involves more than just picking a name from a list. You need to understand the options, the coverage, and the reputation of the insurer. This section helps you navigate the insurance market effectively.

Research The Insurer’s Reputation

Check the insurer’s reputation in the industry. Read reviews and feedback from other businesses. A well-regarded company is likely to offer reliable services. Consider their standing with regulatory bodies. This offers insights into their trustworthiness and reliability.

Evaluate Coverage Options

Different insurers provide various coverage options. Study these carefully to ensure they meet your business needs. Look for comprehensive packages that cover potential risks. Ensure the policy includes liability, theft, and damage coverage. Your business needs robust protection.

Consider Financial Stability

Financial stability of the insurer is critical. A financially sound company can handle claims efficiently. Check their financial ratings and reports. This assures you they will be able to pay out claims when needed.

Assess Customer Service Quality

Customer service plays a vital role in your experience. Evaluate how responsive and helpful the insurer is. Good service makes handling claims smoother. Seek an insurer with 24/7 support for peace of mind.

Look For Customized Solutions

Each car rental business has unique needs. Find insurers offering tailored solutions. Custom packages fit your specific requirements better. This ensures you get the best coverage without unnecessary extras.

Check Claim Process Efficiency

An efficient claim process is essential. Learn about the insurer’s claim procedures. Fast and hassle-free claims save time and stress. Ask about average claim processing times to gauge efficiency.

Compare Premium Costs

Premium costs affect your business budget. Compare different insurers to find competitive rates. Ensure you understand what is included in the premiums. Look for value rather than just a low price.

Policy Comparisons

Understanding the right insurance policy for your car rental business in Malaysia is crucial. Not all policies offer the same coverage or benefits. Comparing different options helps you find the best fit for your needs. This section will guide you through key comparisons. You will make informed decisions for your business.

Policy Coverage Details

Every insurance policy has unique coverage details. Some cover theft and damage. Others may include personal accident coverage. Check if natural disasters are included. Understanding these details ensures proper protection. Choose a policy that covers common risks in Malaysia.

Premium Costs

Premium costs can vary widely between policies. Look for affordable options without sacrificing coverage. Cheaper premiums might mean less coverage. Balance cost with the level of protection offered. Compare several policies to find cost-effective options.

Exclusions And Limitations

Every policy has exclusions and limitations. Some policies do not cover certain drivers. Others may exclude specific types of damages. Read the fine print carefully. Knowing these details can prevent unexpected expenses. Choose a policy with fewer exclusions.

Claim Process

The claim process should be straightforward. A complicated process can cause delays. Look for insurers with a simple claim procedure. Fast and easy claims save time and stress. Ask about the average claim processing time.

Customer Support

Good customer support is essential. You need quick responses in emergencies. Choose an insurer known for excellent service. Check reviews and testimonials. Reliable customer support gives peace of mind.

Cost Factors

Understanding the insurance costs for your car rental business in Malaysia is crucial. Insurance plays a vital role in protecting your vehicles and managing risks. Various factors affect the cost of insurance, making it essential to evaluate each aspect carefully.

Insurance Premiums

Insurance premiums are the regular payments you make for coverage. These depend on several factors, including the vehicle type and usage. Premiums can vary based on the number of cars in your fleet. The more vehicles you insure, the higher the premiums might be.

Vehicle Type

The type of vehicle impacts insurance costs significantly. Luxury cars often have higher insurance rates due to their value. Commercial vehicles might have different rates compared to standard passenger cars. Assessing the vehicle type is important for accurate cost estimation.

Location Of Operation

Where your business operates affects insurance pricing. Urban areas might have higher insurance costs due to increased risk factors. Rural locations may offer lower rates. Consider the location carefully when planning your insurance budget.

Driver Profiles

Driver profiles are another key factor. Experienced drivers may lower your insurance costs. Younger drivers or those with less experience might increase premiums. Maintaining a record of your drivers can help in managing insurance expenses effectively.

Claim History

Your business’s claim history influences insurance costs. Frequent claims can lead to higher premiums. A clean claim history may help in reducing expenses. Keep a detailed record of past claims to negotiate better rates with insurers.

Coverage Level

The level of coverage chosen also affects costs. Comprehensive coverage is more expensive than basic liability insurance. Evaluate what coverage your business truly needs. Balancing protection and cost is important for financial stability.

Legal Requirements In Malaysia

Understanding insurance is crucial for any car rental business in Malaysia. Business owners must comply with the country’s legal requirements. This ensures both compliance and protection. Malaysia’s laws mandate specific insurance coverages for vehicles. These regulations exist to protect drivers, passengers, and third parties. Familiarity with these legal requirements is essential for a successful operation.

Mandatory Insurance Policies

Car rental businesses must have third-party insurance. This is the minimum legal requirement. Third-party insurance covers damages to others. It does not cover the rental car itself. This insurance is essential for all vehicles on Malaysian roads.

Additional Insurance Options

Beyond mandatory insurance, consider additional coverages. Comprehensive insurance covers damages to the rental car. It also covers theft and fire incidents. This insurance provides broader protection. It gives peace of mind to both renters and owners.

Legal Compliance And Penalties

Failing to insure a vehicle properly leads to penalties. Uninsured vehicles face fines and possible impoundment. Legal compliance protects your business from these risks. Adhering to regulations is not just wise; it’s necessary.

Documentation And Record-keeping

Maintain accurate insurance records for all vehicles. Proper documentation helps in legal disputes. It also aids in insurance claims. Keeping organized records ensures business compliance. It’s a key aspect of managing a car rental business effectively.

Understanding Exclusions

Grasping exclusions in car rental insurance is crucial for Malaysian business owners. These exclusions often involve damages not covered by the policy. Understanding these can prevent unexpected costs and ensure smooth operations.

Understanding insurance exclusions for your car rental business in Malaysia can be a tricky yet essential part of your operations. Navigating these exclusions ensures that you’re not caught off guard when an unforeseen event happens. It’s not just about knowing what’s covered but also about understanding what isn’t. This knowledge can protect your business from unexpected expenses and liabilities.What Are Insurance Exclusions?

Insurance exclusions are specific conditions or circumstances that are not covered by your policy. Knowing these can save you from surprise financial burdens. For instance, your policy might exclude coverage for damages caused by natural disasters.Common Exclusions In Car Rental Insurance

Policies often exclude intentional damage or illegal activities. If a renter drives under the influence, any resulting damages might not be covered. Theft coverage might also exclude cases where negligence is involved.Why Understanding Exclusions Is Crucial

Imagine a renter returning a vehicle damaged by floodwaters. If natural disasters are excluded, you bear the repair costs. This kind of exclusion knowledge empowers you to make informed decisions about your rental agreements.How To Identify Exclusions In Your Policy

Exclusions are typically listed in a separate section of your policy document. Read through it carefully, and don’t hesitate to ask your insurer for clarification. A proactive approach prevents costly surprises.Strategies To Mitigate Risks From Exclusions

Consider additional coverage if exclusions leave significant gaps. It might be worth investing in a supplementary policy that covers excluded risks. This small step could save you substantial amounts in the long run.Questions To Ask Your Insurance Provider

You might wonder, “What scenarios are excluded from my policy?” Ask about exclusions related to weather, theft, and driver behavior. Understanding these can help you tailor your rental agreements to minimize risks.Real-world Scenarios: Learning From Experience

A fellow car rental owner once shared how they learned the hard way. They faced hefty repair bills after a renter damaged a vehicle off-road—an exclusion in their policy. This experience underscored the importance of understanding exclusions.Conclusion: Taking Action On Exclusions

Do you know all the exclusions in your current policy? If not, it’s time to dig deeper and ask questions. This knowledge is essential for safeguarding your business against unforeseen costs and liabilities.Claims Process Simplified

Understanding the claims process in car rental insurance is crucial. It ensures smooth operations in your business. Many find the claims process daunting. Simplifying it helps you save time and stress. This section will guide you through the essentials. Get to know the steps and key considerations.

Understanding The Basics

Start with the basics of your insurance policy. Know what coverage you have. This includes liability, collision, and comprehensive coverage. Each type has specific claims processes. Familiarize yourself with the terms and conditions. This knowledge helps during the claims process.

Reporting The Incident

Report the incident to your insurer immediately. Prompt reporting is crucial. Provide all necessary details about the incident. This includes the date, time, and location. Document any damage with photos or videos. This evidence supports your claim.

Filing The Claim

Filing the claim involves specific steps. Contact your insurance agent or provider. Fill out the required claim form accurately. Attach all supporting documents. These may include police reports and repair estimates. Ensure all information is complete and correct.

Following Up With The Insurer

Stay in touch with your insurer throughout the process. Regular follow-ups ensure progress on your claim. Ask for updates on the claim status. Be proactive in providing any additional information. This helps speed up the resolution.

Receiving The Settlement

Once approved, receive the claim settlement. The insurer will guide you on the next steps. Use the settlement funds for repairs or replacement. Keep records of all transactions. This documentation is vital for future reference.

:max_bytes(150000):strip_icc()/renttoown-car-how-it-works-final-565a4533d9794063aa710463285d17bf.png)

Credit: www.investopedia.com

Managing Risk

Navigating insurance options is crucial for car rental businesses in Malaysia. Assessing coverage helps manage potential risks effectively. Understanding policies ensures protection against unforeseen incidents, safeguarding assets and operations.

Understanding insurance for your car rental business in Malaysia can be daunting. Managing risk is a critical aspect, ensuring your business is protected from unforeseen events. What happens when an accident occurs? How can you safeguard your vehicles and your financial interests? Let’s dive into some practical strategies to manage risk effectively. ###Identify Potential Risks

Identifying risks is the first step in managing them. Consider the common issues like accidents, theft, or damage. Have you thought about natural disasters? Malaysia’s weather can be unpredictable. Create a list of potential risks that your business might face. Being aware helps you plan better. ###Choose The Right Insurance Coverage

Having the right insurance coverage is essential. Don’t just pick the cheapest option. Evaluate what each policy covers. Does it protect against accidents? Does it include theft or damage coverage? Make sure your policy aligns with your identified risks. ###Implement Safety Measures

Safety measures can significantly reduce risk. Train your staff on safe driving practices. Install GPS trackers in your vehicles. Are your cars regularly serviced? Proper maintenance can prevent many issues. Simple precautions can save you money and stress. ###Regularly Review Your Insurance Policies

Regular reviews of your policies keep your coverage relevant. When was the last time you checked your policy? Insurance needs change as your business grows. Schedule annual reviews to adjust your coverage. Stay proactive in protecting your assets. ###Document Incidents Thoroughly

Thorough documentation is vital in claims processing. Keep detailed records of incidents. Photos, witness statements, and police reports are crucial. How prepared are you to handle a claim? Being organized speeds up the process and ensures you get the coverage you deserve. Managing risk in your car rental business in Malaysia is about preparation and vigilance. Is your business ready to handle unexpected challenges? By identifying risks and securing the right coverage, you pave the way for a safer, more secure future.Customer Education

Understanding insurance is crucial for car rental businesses in Malaysia. It safeguards against unexpected damages and liabilities. Ensuring proper coverage protects your investment and builds customer trust.

Understanding the nuances of insurance can be a game changer for your car rental business in Malaysia. Educating your customers about their insurance options and responsibilities is not just a service, but a critical value addition. It builds trust, enhances customer satisfaction, and could be the differentiator that sets your business apart from competitors. ###Why Customer Education Is Crucial

Customers often overlook the importance of understanding insurance in car rentals. They might assume that basic coverage suffices without considering potential risks. Your role is to clarify these misconceptions and explain the benefits of comprehensive coverage. By doing so, you not only protect your business but also enhance customer loyalty. Wouldn’t you prefer to rent a car from someone who ensures you drive away with peace of mind? ###Explaining Insurance Options Clearly

Break down the insurance options available in simple terms. Use bullet points for clarity: – Collision Damage Waiver (CDW): Reduces your responsibility in case of an accident. – Personal Accident Insurance (PAI): Covers medical expenses for injuries sustained in an accident. – Theft Protection (TP): Protects against financial loss if the car is stolen. Ensure that customers understand what each option covers and what it doesn’t. Encourage them to ask questions. How else can they make informed choices? ###Leveraging Personal Stories

Share real-life experiences where understanding insurance made a difference. Perhaps a customer faced unexpected costs after declining CDW. Such stories resonate and underline the importance of being informed. In my own business, a client once thanked us profusely after an accident. They were relieved they had opted for full coverage. This highlighted the value of our educational efforts. ###Providing Easy-to-understand Resources

Offer brochures, videos, or a dedicated FAQ section on your website. Make these resources accessible and straightforward. Use diagrams or infographics to illustrate complex information. A quick guide or checklist can be invaluable. It allows customers to review their choices at their convenience. Remember, a well-informed customer is a happy customer. ###Encouraging Customer Feedback

Invite feedback on your educational materials and processes. Are they helpful? Do they address customer concerns? Use this feedback to refine your approach. Continuous improvement ensures you meet customer needs effectively. What better way to show you care about their experience? ###Building Trust Through Transparency

Transparency is key. Be upfront about costs, coverage limits, and exclusions. This honesty fosters trust and strengthens your reputation. Would you trust a business that hides vital information? Your customers will appreciate your openness and be more likely to return. By focusing on customer education, you elevate your service, foster trust, and ensure your clients are well-informed. This proactive approach not only safeguards your business but also empowers your customers, making them more confident in their choices.Partnering With Brokers

Understanding insurance is crucial for your car rental business in Malaysia. Partnering with brokers can simplify this process. Brokers serve as intermediaries. They bridge the gap between your business and insurance companies. They can help you find the best deals. This partnership can save time and money.

Partnering With Brokers: The Key Benefits

Brokers offer expertise in the insurance market. They understand the complexities and nuances. They negotiate better terms on your behalf. This can lead to cost savings. Brokers can also offer tailored insurance solutions. These solutions fit your specific business needs. This customization is invaluable for a growing business.

How Brokers Help Navigate Policy Options

There are many insurance policies available. Each has different terms and conditions. Brokers help you compare these options. They explain the differences in simple terms. This guidance aids in making informed decisions. Choosing the right policy becomes easier.

Building A Long-term Relationship With Brokers

Partnering with brokers isn’t a one-time event. It’s a long-term relationship. Brokers provide ongoing support. They assist with claims and policy renewals. Their continued guidance ensures your business remains protected. This support is essential for peace of mind.

Trust And Communication With Your Broker

Trust is crucial in any partnership. Open communication with your broker fosters trust. Sharing your business goals helps them understand your needs. This understanding leads to better insurance solutions. A good broker listens and responds promptly. This ensures a smooth partnership.

Choosing The Right Broker For Your Business

Not all brokers are the same. Research and choose carefully. Look for brokers with experience in the car rental industry. Check their reputation and client reviews. A good broker will have a proven track record. They should be responsive and knowledgeable. This ensures you receive the best service possible.

Innovative Insurance Solutions

Car rental businesses in Malaysia face unique insurance needs. Innovative insurance solutions provide tailored coverage options. These solutions help protect your business and customers effectively. Understanding these options can enhance your business operations.

Flexible Coverage Plans

Flexible coverage plans cater to diverse business models. They offer customizable options for different vehicle types. Whether you rent luxury cars or economy vehicles, there’s a plan for you. Adjust coverage levels based on your fleet’s unique needs.

Telematics-based Insurance

Telematics-based insurance uses technology to track vehicle data. It provides insights into driving habits and vehicle usage. This information helps in calculating more accurate premiums. It ensures fairness and transparency in the pricing model.

Bundled Insurance Packages

Bundled insurance packages offer comprehensive protection. They include liability, collision, and personal injury coverage. Bundling can reduce overall costs and simplify management. It streamlines your insurance processes with a single provider.

Pay-as-you-go Options

Pay-as-you-go insurance adapts to your business’s activity level. You pay premiums based on actual usage. This model suits businesses with fluctuating demand. It provides cost savings during off-peak seasons.

Digital Claims Processing

Digital claims processing speeds up the claims settlement process. It reduces paperwork and manual errors. Customers can file claims online, improving their experience. Quick settlements enhance trust in your rental service.

Handling Disputes

Handling disputes in your car rental business in Malaysia is crucial. Disputes can arise from various issues, such as damages or misunderstandings. Understanding how to manage these conflicts efficiently can save time and costs. A well-prepared strategy ensures smooth operations and customer satisfaction.

Understanding Common Disputes

Common disputes include damage claims and billing issues. Misunderstandings about insurance coverage often lead to conflicts. Clear communication with customers helps prevent these disputes. Providing detailed explanations of terms and conditions is essential.

Creating A Dispute Resolution Process

Establish a clear dispute resolution process. This process should be transparent and easy to understand. Train your staff on handling disputes professionally. Ensure they know the insurance policy details.

Documenting Incidents

Keep thorough records of all incidents. Documentation helps in resolving disputes efficiently. Photos and written reports are vital for evidence. Make sure all documentation is accurate and complete.

Engaging Third-party Mediators

Consider using third-party mediators for complex disputes. Mediators provide unbiased solutions. They help maintain a positive relationship with customers. This approach can be more effective than direct negotiations.

Reviewing Insurance Policies

Regularly review your insurance policies. Ensure they cover potential dispute scenarios. Updating policies helps avoid future conflicts. It is essential for protecting your business.

Communicating With Customers

Effective communication is key. Ensure customers understand their insurance coverage. Use simple language and clear explanations. This reduces misunderstandings and potential disputes.

Learning From Past Disputes

Analyze past disputes for insights. Identify patterns and common issues. Use these insights to improve processes. Continuous improvement helps reduce future disputes.

Future Trends

Understanding the future trends in insurance for car rental businesses in Malaysia is crucial. As the industry evolves, adapting to emerging trends is vital. These trends shape how businesses manage risks and protect assets. Embracing future trends ensures staying ahead in a competitive market.

Technological Advancements In Insurance

Technology is transforming the insurance landscape. Digital platforms simplify the insurance process. Online portals enable easy access to policy information. Automation reduces paperwork and speeds up claims. Artificial intelligence predicts risks, offering tailored insurance solutions.

Telematics And Usage-based Insurance

Telematics technology is gaining popularity. It tracks vehicle usage and driving behavior. This data enables usage-based insurance models. Premiums are calculated based on actual vehicle usage. It offers flexibility and potential cost savings for rental businesses.

Environmental Considerations And Green Insurance Policies

Environmental awareness is influencing insurance policies. Green insurance supports eco-friendly practices. It covers vehicles with lower emissions. Rental businesses benefit by aligning with sustainable practices. This trend promotes corporate social responsibility.

Regulatory Changes And Compliance

Regulations are continually evolving. Staying compliant is essential for car rental businesses. New laws may impact insurance requirements. Understanding these changes avoids legal complications. It ensures business operations run smoothly.

Customer-centric Insurance Solutions

Customer expectations are changing. Personalized insurance solutions are in demand. Insurers offer customizable policies. These cater to unique business needs. Enhancing customer experience is a priority. It builds loyalty and trust in the brand.

Data Privacy And Security Concerns

Data privacy is a growing concern. Insurers must ensure data protection. Secure systems safeguard sensitive information. Compliance with data privacy laws is crucial. It prevents unauthorized access and data breaches.

Faqs On Car Rental Insurance

Navigating car rental insurance in Malaysia can seem complex. FAQs help clarify coverage types, costs, and claims processes. Knowing these details ensures better protection for your rental business.

Understanding the insurance essentials for your car rental business in Malaysia can be a daunting task. You might wonder what types of coverage are necessary or how claims are processed. To help you navigate the complexities, let’s delve into some frequently asked questions about car rental insurance. These questions cover the basics and help ensure that you protect your business and your customers effectively.What Types Of Insurance Do I Need For My Car Rental Business?

Your business may require several types of insurance. Liability insurance is crucial as it covers damages to third parties. Collision coverage can protect your fleet from accident-related damages. Comprehensive insurance is also advisable since it covers non-collision incidents like theft or natural disasters.How Can I Ensure My Insurance Coverage Is Adequate?

Evaluate your fleet size and the risks involved. Speak with an insurance advisor to tailor a plan that suits your needs. Regularly review your policy to account for business growth or changes in Malaysian regulations.What Are The Common Exclusions In Car Rental Insurance?

Be aware of exclusions to avoid unpleasant surprises. Some common exclusions include damages from illegal activities and unreported incidents. Ensure your customers understand these exclusions to avoid disputes.How Are Claims Processed In Malaysia?

Claims can be processed through your insurance provider. Gather all necessary documentation, like accident reports and photos. Prompt submission can expedite the process, ensuring your vehicles return to service quickly.How Can I Educate My Customers About Insurance?

Communicate clearly with your customers. Provide brochures or digital resources explaining coverage and exclusions. Consider holding brief orientation sessions for first-time renters.Are There Ways To Lower Insurance Costs?

Yes, several strategies can help. Opt for higher deductibles to reduce premiums. Maintain your vehicles well and implement safety measures to minimize risk. Regularly compare providers to find competitive rates. As you manage your car rental business, understanding insurance is vital. It not only safeguards your assets but also builds trust with your customers. Have you ever faced an insurance challenge? Share your experiences and solutions with others in the industry. Your insights could be invaluable in helping someone else navigate their insurance journey.Frequently Asked Questions

What Is Car Rental Insurance?

Car rental insurance covers damages, theft, and liability for rental vehicles. It’s essential for protecting your business from unforeseen expenses. In Malaysia, insurance options vary, so understanding policy details is crucial. Always ensure your coverage aligns with your business needs and local regulations.

Why Is Insurance Important For Rental Businesses?

Insurance protects your business from financial losses due to accidents or theft. It ensures continuity and mitigates risks associated with vehicle rentals. In Malaysia, having comprehensive insurance is crucial to comply with legal requirements and safeguard your investment.

How To Choose The Right Insurance Policy?

To choose the right policy, assess your business needs and budget. Compare different insurers and coverage options available in Malaysia. Consider factors like vehicle type, coverage limits, and additional riders. Consult with insurance professionals for tailored advice.

What Types Of Coverage Are Available?

Common coverage types include collision damage waiver, theft protection, and third-party liability. Each offers varying levels of protection for different risks. In Malaysia, additional options like personal accident insurance can also be considered. Evaluate these to meet your business requirements.

Conclusion

Choosing the right insurance is crucial for your car rental business. It protects against unexpected costs and ensures smooth operations. Understanding coverage types helps you make informed decisions. This knowledge can save money and prevent legal issues. Always review policies carefully.

Compare options before committing. Seek advice from insurance experts when needed. Their guidance can be valuable. Remember, a well-insured business is a secure business. Stay informed and proactive to keep your business safe. Investing time in understanding insurance pays off.

Your business deserves the best protection. Keep learning and stay prepared.